Sponsored

The Latest from TechCrunch |  |

- Designing for Mobile: 7 Guidelines for Startups to Follow

- How Facebook Really Stacks Up Against Pre-IPO Google

- The Phone Stacking Game: Let’s Make This A Thing

- I’m A New York Times Subscriber, So Where’s My Tote Bag?

- Labor Efficiency: The Next Great Internet Disruption

- Facebook – Run from the Bulls?

- An Arab Spring For IT

- Gillmor Gang 02.04.12 (TCTV)

- Algorithms/Data vs. Analysts/Reports: Fight!

| Designing for Mobile: 7 Guidelines for Startups to Follow Posted: 05 Feb 2012 09:00 AM PST  This is a guest post by Ryan Spoon (@ryanspoon), a principal at Polaris Ventures. Read more about Ryan on his blog at ryanspoon.com. As an investor, I've seen hundreds of mobile application pitches. And as a consumer, I've downloaded hundreds more – some out of curiosity and others in the hope that I'll find something so useful and exciting that I'll make room for it on my iPhone's home screen. From both perspectives, I am rarely excited by download numbers. What gets my attention is engagement: how frequently an application is used and how engaged those users are. This ultimately is the barometer for an application's utility and/or strength of community. And if either of those two factors are strong, growth will certainly come. Just ask Instagram, Evernote, LogMeIn and others. Creating great mobile experiences requires dedication to building product specifically for mobile. It sounds obvious, but it's so often overlooked. Mobile users have different needs, desires and environments; and as the application creator, you have different opportunities to create utility and engagement. With that in mind – and with the help of my former eBay colleague and Dogpatch Labs resident, Rob Abbott (founder of EGG HAUS and Critiq), we've put together 7 design guidelines to consider when building for mobile. Just like the presentations on leveraging Facebook (both on-Facebook.com and off-Facebook) and Twitter, success comes from building meaningful experiences that are honest to the native environments. |

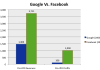

| How Facebook Really Stacks Up Against Pre-IPO Google Posted: 05 Feb 2012 08:21 AM PST  Now that Facebook is preparing the biggest tech IPO in history, it is possible to compare its financials and potential market value to Google’s when it went public. At first glance, all of Facebook’s numbers look bigger. Its pre-IPO revenues of $3.7 billion in 2011 are more than two and a half times larger than Google’s 2003 revenues of $1.5 billion (Google’s IPO was in 2004). Facebook’s $1 billion in profits is ten times larger than Google’s pre-IPO profits of $106 million. And its expected market cap of between $85 billion and $100 billion will dwarf Google’s IPO market cap of $23 billion. Facebook, no doubt, will be emphasizing these differences. But in many ways it is a false comparison. Facebook is going public after 8 years as a private company. Google went public much earlier in its development, after 5 full years. So, yes, Facebook at Year 8 is much bigger than Google was at Year 5 of its trajectory. A better way to see how the two companies stack up is to compare their revenues and profits at the same points in their histories. In 2008, Facebook’s fifth year of existence, its revenues were only $272 million, and it lost $56 million. If you chart Facebook’s revenues for the past five years and compare them to Google’s for the five-year period preceding its IPO (see below), a truer picture emerges of each company’s size at similar points in time. You need to compare Facebook as a 5-year-old to Google as a 5-year-old. Matching both companies year-for-year, its is clear that Google grew faster and was always substantially bigger no matter what year you look at. Year 8 for Google was 2006, when its revenues were $10.6 billion and its profits were $3.5 billion. As an 8-year-old, Google’s profits were almost as large as Facebook’s revenues as an 8-year-old. (Google was incorporated in September, 1998, so I am using 1999 as Year 1 for the purposes of this analysis. Facebook started in January, 2004, which I am counting as it’s first full year). But which company grew faster? It turns out that the 5-year compound annual growth rate for each one’s revenues during these comparable periods (2002-2006 for Google, and 2007-2011 for Facebook) was almost exactly the same: 89 percent a year (Facebook grew a smidgen faster at 89.22 percent a year versus 88.96 percent for Google, but Google started with almost twice the revenue and thus ended up much larger five years later). Facebook’s growth is astounding, but it is important to keep it in perspective. In many ways, it is still trying to catch up to Google’s past. |

| The Phone Stacking Game: Let’s Make This A Thing Posted: 04 Feb 2012 06:00 PM PST  So it’s Saturday night and you’re out with friend. Are they the inconsiderate jerk who can’t stop checking their smartphone? Or is that you? Either way, here’s one way to make dinner a little more interesting. I’ve seen/heard this described as both “The Phone Stacking Game” and “Don’t Be a Dick During Meals”. It’s been mentioned on a couple of blogs, but a quick straw poll of my friends suggests that it hasn’t become widespread yet, at least on the West Coast. Which is a shame, because it’s perfect for folks in tech. Here’s how it works: At the beginning of the meal, everyone puts their phone face down at the center of the table. As time goes on, you’ll hear various calls, texts, and emails, but you can’t pick up your phone. If you’re the first one to give in to temptation, you’re buying dinner for everyone else. If no one picks up, then everyone pays for themselves. You can explain the game in a few different ways. Most obviously, it could be a protest against the incessant, unthinking use of cell phones during social gatherings. Or maybe it’s a game that acknowledges the new reality and tests your willpower accordingly. Personally, I like to think of it as a free market exercise. After all, people love to say, “Sorry, but I have to take this.” Do you have to answer it? Really? Is it that important to you? Great, then you can pay. No matter what the explanation, it could make for a tense meal. And I look forward to defeating MG Siegler. [image via Kempt] |

| I’m A New York Times Subscriber, So Where’s My Tote Bag? Posted: 04 Feb 2012 04:21 PM PST  The New York Times released its latest earnings report earlier this week, spurring another round of discussion about the newspaper’s paywall, which was launched near the beginning of last year. The consensus: Early signs are positive, but it’s not doing well enough to offset plummeting print ad revenue. What’s the solution? Well, if you listen to a number of online media pundits, it’s all about bringing more value to the most devoted members of The Times’ readership. Over at GigaOm, Matthew Ingram suggests, “Regular readers should get more than just a sales rep hitting them up for a monthly payment — the fact that they are a devoted fan should entitle them to earn rewards, whether it's money off their subscription for interacting with the paper, or offers that others don't get.” It’s a point he’s made before, as has Clay Shirky, who wrote that “this may be the year where we see how papers figure out how to reward the people most committed to their long-term survival.” I’m a happy New York Times subscriber, but I have to say: I don’t think The Times is doing a good job on this front, or much of a job at all. It’s odd, because NYTimes.com general manager Denise Warren appeared on NPR’s Talk of the Nation with Shirky, and she seemed largely on-board with his ideas:

Warren goes on to outline some of the advantages of a Times digital subscription — not just access to unlimited articles (20 per month is the limit for non-paying readers, though there are lots of ways around it), but also to the Times smartphone and tablet apps, as well as bonus apps like Politics and Collections, and email newsletters giving behind-the-scenes portraits of the newsroom. Now, as someone who’s constantly reading The Times on both his laptop and his iPhone, I’m happy to fork over $15 a month isn’t a bad price for those features, but I also feel like they’re a missed opportunity. As Shirky puts it, newspapers “must also appeal to its readers' non-financial and non-transactional motivations: loyalty, gratitude, dedication to the mission, a sense of identification with the paper, an urge to preserve it as an institution rather than a business.” Those seem to be some of the main reasons people subscribed, but The Times isn’t doing much to encourage that feeling. The closest it comes is through its newsletters, but those newsletters also have the clearest shortcomings. I’ve been a Times subscriber since the program started in March, and in that time, I’ve received a total nine newsletters. And of those, five are “Innovations” emails, which function as ads for new features on The Times website — useful, maybe, but not particularly loyalty-inspiring. Emails offering “The Story Behind The Story” are better (though a still a little impersonal for my taste), but they show up about once every two months. Talk of the Nation host Neal Conan makes an interesting comment about this during his interview with Shirky and Warren: He notes that NPR has convinced one in six listeners to donate, while The Times has only convinced one in a hundred to subscribe. He later says, “If you get into the tote bag business, we’re going to have a problem.” Here’s the thing about those tote bags — they’re nice, but as NPR broadcasters constantly remind listeners, they’re not the real reason to donate. To pick an example from my local NPR station, is there anyone who would pay $144 just because it’s a great deal on a KQED hoodie? (I hope not.) They make the donation because they love KQED, and the hoodie is a sign of their dedication. Compare that to The Times digital subscription page and pricing model, which are all about functionality — there are three pricing levels, and they reflect different levels of mobile access. That approach has its limitations — from a functional equivalent, it can be hard to justify the price, especially when you take into account the easiness of circumventing the paywall and the low price of other online services. (As a friend pointed out, it’s $15 a month for the cheapest plan, which is more than a basic Netflix subscription.) To keep The Times in business, however, I’m happy to pay $15 a month, and I’d probably be fine paying significantly more. I don’t think the basic subscription price should change (if anything, it seems a little high), but I suspect the paper could also offer higher price points without providing a dramatic improvement in the product. It just needs rewards that make subscribers feel loyal to The Times, and maybe a little special — the digital equivalent of a tote bag. |

| Labor Efficiency: The Next Great Internet Disruption Posted: 04 Feb 2012 02:00 PM PST  Editor’s note: Nick Cronin is a former corporate attorney and now the President and Founder of ExpertBids.com, which is based in Chicago. For more than a decade now, the Internet has done a great job of making things in our day-to-day lives more efficient by easily connecting parties who can have a mutually beneficial personal or business relationship. This same idea is now on the verge of disrupting labor and changing the definition of employment as we know it. The Rise of the Independent Worker. Over the past couple of years, there has been a huge increase in the number of workers who operate as some sort of independent, free-agent contractor or consultant. Though the numbers vary greatly, the consensus seems to be around 20 percent of the U.S. workforce, and growing (with some estimates up to 50 percent by 2020). Think about that, one in every five workers are currently unattached to any one company! Expert explanations for this rise vary as much as the number itself, but I believe the two most important factors, by far, are:

Armed with the technology and connectedness, people are setting out on their own in record numbers. But where are they finding work? Changes in How Companies 'Hire' Labor. Labor efficiency is about having the right workers for the tasks which need to be accomplished. This includes tasks of all types and in all areas. More than ever, this is being accomplished by having lean, flexible workforces which come and go as projects demand. Increasingly, employers are parsing up tasks and having temporary, project-basis workers complete the tasks. Take one gigantic U.S. company, Caterpillar Inc., who recently reported that they hired almost 30,000 flexible, contingent workers in the last quarter of 2011. By almost every study, companies of all sizes are emphasizing a lean workforce, and hiring on project-basis engagements more and more (though not all are as drastic as Caterpillar). This trend is not limited to factory workers or computer programmers or any one group — workers in every industry and profession are seeing this increase. For a company to hire someone, there are many costs beyond a salary and benefits (which in and of themselves are substantial!). There are recruitment efforts, on-boarding costs such as supplies and training, and finally costs when the employee leaves, such as unemployment premiums, severance packages, and HR costs. Now, instead of choosing to go the route of employing someone, companies have the option of hiring some of the millions of independent workers out there for substantially less. Instead of paying all the associated costs, businesses can parse tasks up into projects and find experts to do them very efficiently – only having to pay for the work completed, not the secondary costs discussed above. Additionally, they can more easily expand and contract their workforce as supply and demand dictate. Not only are the large businesses hiring more independents, this trend is trickling all the way down to the millions of bootstrapped startups who hire (outside of the founders) only independents for projects as they grow their company. The era of the lean, flexible workforce is here and guess where both companies and independents are increasingly locating each other. Yep: The Internet. Time for Disruption. There are already plenty of companies out there connecting one party who needs a service with another who can provide it. TaskRabbit and Zaarly specifically are two startups that have grown very quickly. But we are just beginning to scratch the surface of how the Internet is going to disrupt labor. The real change will come as more and more of the traditional job creators, small businesses all the way up to the Fortune 500s, realize the benefits of flexible workforces and more and more individuals take the plunge into independent, free-agent land — whether by necessity or choice. There are many companies working to facilitate the connection between project-basis workers and companies. Marketplaces like ODesk and Elance provide a worldwide platform of freelancers in a variety of different fields. Some of these marketplaces are aimed more towards commoditized services, but increasingly they encompass services of all types. OnForce allows companies to retain the services of IT professionals for projects. WorkMarket is a labor resource platform. Crowdspring and 99Designs are creative services marketplaces. And finally (though there are countless others that could be included here), my company ExpertBids.com is a professional services marketplace for consultants, lawyers, and accountants. Every day it seems a new vertical labor marketplace launches. There are many obstacles these companies must overcome still, but change is coming. Some have criticized this shift, saying this type of labor and employment is only increasing inequality and the drawbacks outweigh the benefits. We need to begin looking deeply into this trend and how it is affecting people, but an efficient labor system can have major advantages to both parties. A marketplace where tasks are accomplished by the right people, at the right time, and at the right price (not lowest price, the right price) may seem to favor the employer. But think about an independent who has very little overhead, can work from anywhere, at anytime, and for anyone and whose income potential is no longer limited by a single salary. Removing wasted time and expenses is something both parties, and the economy as a whole, can gain tremendously from. That is where all of the online labor marketplaces, ExpertBids included, need to assist. We must create efficient platforms that remove the barriers for these two parties to connect in a mutually beneficial relationship. |

| Facebook – Run from the Bulls? Posted: 04 Feb 2012 11:28 AM PST  Editor's note: Guest author Keith Teare is General Partner at his incubator Archimedes Labs and CEO of newly funded just.me. He was a co-founder of TechCrunch. Much ink has been spilled these past few days on the Facebook IPO filing. Much of it analyses the details revealed in the S1 initial document. Some of it has focused on revenue and growth; some of it on control and corporate governance, some on valuation and how reasonable or not it is likely to be, and a little on whether or not the IPO represents the end of Facebook's growth cycle. So, should you be a bull, and buy? Or should you run as fast as you can away from the bulls? For guidance turn to the risk factors part of the filing. For me, the most interesting part of the document is that part focused on Facebook's mobile strategy and associated risks, and what that tells us to be alert to in the future. Now, to be clear, Facebook and its employees have done the most wonderful job of riding the transformation of the Internet from a place where anonymous individuals surfed the web, consumed information and media and accessed services to discover relevant things into an Internet where named individuals publish information to each other and discover things from friends. Facebook dominates the modern Internet. Its APIs extend its reach outside of its garden into almost every website on the planet – this one included. It is awesome to behold and it generates significant revenues already, and even more significant profits. Hats off to all involved. This success shouldn't blind us to the relative size of company we are talking about. Last week Apple reported profits of over $13 billion for a quarter, Google's revenues were lower than that number, and Facebook's revenues are lower than Google’s profits. Facebook is huge by startup standards, but not by Internet standards. There is much more in its future. But this article isn't about that. It is about the context within which the human Facebook IPO is happening. The Facebook S1 is clear on that context. In the risk factors of its filing it states:

Facebook initial S1 filing, 1 Feb 2012, page 13 The reason this risk factor jumps out of the page – for me – is that this trend to growing mobile use is inevitable. What is more, it will be both rapid and enormous. How do we know this? Well, human beings are flocking to mobile platforms in droves. This is happening to such an extent that Kleiner Perkins partner Mary Meeker went on the record almost 1 year ago to say that we are now in the 5th major technology cycle of the past half century (mainframe; mini-computer; desktop; internet and now mobile) and that mobile traffic will "grow 26 times over the next 5 years". The presentation linked above is 56 slides long and is well worth a read. So the risk that "our users could decide to increasingly access our products primarily through mobile devices," is not a risk. It is a certainty. When Google reported its financial results for the quarter 2 weeks ago it failed to meet a key metric – Cost Per Click advertising rates. This too was driven by the growth in the relative proportion of traffic derived from mobile. In mobile, ad clicks are fewer and ad rates are lower. Google's present – and Facebook's future – involves the painful fact that the very success of mobile platforms in helping human beings be productive, on the go, has a negative impact on the desktop-based advertising programs of the past 10 years. Mobile growth impacts web advertising revenues, except of course for Apple who make money from hardware and software and so benefits from these trends. The reason is simple. We do less ad-centric activities on mobile than we did on the web. And we are less likely to click away on an ad when we are focused on a specific goal on a largely single window device. The challenge faced by any content based mobile platform will be to try and figure out a revenue strategy that can monetize mobile use as mobile minutes cannibalize desktop minutes in the months and years ahead. There are many efforts to figure this out. From virtual goods in the context of games (Zynga and others); to subscriptions for high quality content (Wall Street Journal, The Economist); to advertising and sponsorships in content (see Fotopedia's "Japan" app); and Payment systems (Square). None of these are the solution – although all are valid and scalable. The billions spent on the web each year by advertisers will have to find a way to be effectively spent in the place consumers increasing will be – on smartphones. The mobile platform needs an innovation that fits it as closely as Google's Adsense and Adwords were a fit for the desktop era. One thing we know for sure. Revolutions in computing are harsh on those who fail to adapt to what is new. Photo credit: Camilo Rueda López |

| Posted: 04 Feb 2012 11:00 AM PST  Editor’s note: Alan S. Cohen is Vice President of Marketing at Nicira. A 20-year IT veteran, Alan has held executive positions at Cisco, Airespace, Tahoe Networks, IBM, US WEST, Coopers & Lybrand, and the Department of Energy. Change in the air. It's palpable. Those of us in the technology world are witnessing a transformation: A buyer-led revolution in how information technology is both produced and consumed. Smartphones and tablets are upsetting the PC order; social applications are impinging on traditional "workforce productivity" and communications applications. And the infrastructure, the underlying electronic "institutions" that make all of this happen, are also undergoing a transformation that promises to reshape the boundary conditions of all the participants. The wave of disruption powered by virtualization, and now, cloud, is rapidly and dramatically reshaping how companies and organizations of all sizes purchase IT and who sells it to us. Said simply, for the first time in a generation, information technology's supply chain is in the state of serious disruption. It truly is an "Arab Spring" for the IT world and when it's over, there will be a host of new companies driving enterprise technology. Don't believe me? Let's establish some historical context. Most revolutions take time. There are always early revolutionaries who pave the way for the change in the system. Although we chart the Arab Spring to events in Tunisia just over a year ago, the underlying currents driving change in the Middle East are decades in the making. In our industry, the antecedents are also more than a decade old. VMware, the early power player in compute virtualization, was founded in 1998. Salesforce, the first big SaaS player, was founded in 1999. The iPod, the progenitor of the contemporary smartphone, was revealed publicly in 2001. For those tuned in to IT's golden oldies channel, there was a transformative revolution in the 1970s. It was called the PC. At the center of these revolutions and disruptions, you will find end users who have a simple mantra: "We want what we want, when we want it, to get our jobs done." Employers have to meet these goals. Yet their job can be doubly difficult: Companies and organizations are frequently locked into existing IT approaches and are now told to do more with less. Business leaders around the world are demanding that the current model of IT, one that has led to a multi-trillion dollar per year industry, become more responsive to their twin goals of business velocity and efficiency. But today, at the beginning of what historians will someday call the “as-a-service” era of technology, there is a new mantra for Enterprise IT: Faster, cheaper, and pay only for what you use. If IT providers do not supply what the end users want, the latter, like the brave individuals who took the streets of Cairo, Tunis, and Tripoli, will take matters into their own hands. Most often, the initial transformation happens as "shadow" IT. Bring your own device is shadow IT. Most SaaS applications start by bypassing IT and going directly to functional groups (managing sales through Salesforce or sharing through Box.net). Think about it: Less than five years ago, people were questioning whether the iPhone was ready for the enterprise. In 2012, Apple is expected to sell $19 billion worth of iPhones and iPads to the enterprise, making iot the 25th largest IT vendor in the world. How’s that for a shadow IT movement? Now it's time for infrastructure. If IT does not provide the end user with the infrastructure they need, the latter can rent it, by the hour or month from companies like Rackspace or Amazon. All you need is a credit card and no approval from IT. What is powering this change? Software. Software will be the new hardware. Like the Arab Spring, traditional powers in IT clearly know about the change that is underway. However, as with so many Middle Eastern heads of state, half-measures toward meeting end user requirements will not be enough. Adding a cool interface to onerous applications or a software stub to a piece of stubborn "iron" will not appease the end users. In our world, it’s change or lose your franchise. Maybe that's why Andy Grove knew only the paranoid survive. Embracing rapid change is not the usual modus operandi for many IT superpowers. The need for top and bottom line growth, and the scrutiny of public markets, does not make changing your business model on-the-fly the easiest task. If you are a multi-billion dollar IT player, how do you explain to your installed base, "Guess what, everything is going to change?" But if you are in IT, you have to ask yourself: What side of history will you wind up on? Update: After seeing some of the reader response in the comment, Cohen sent the following note: “I apologize for offending people with the analogy used in this post — it was certainly not the intent. The intent was only to spur discussion on the transformation underway in IT.” |

| Posted: 04 Feb 2012 10:15 AM PST  The Gillmor Gang — Robert Scoble, Kevin Marks, John Taschek, and Steve Gillmor — trembled in the face of Facebook’s IPO and all-out war on the open Web, also known as Google. Me, I go back to Bill Gates during the DOJ deposition when he basically said we don’t need no steenkin’ breakup when Google will come along and be invented. @kevinmarks makes a good college (fitting) try of defending the open schmopen set, while none of us seem to notice Social Spring just keeps on rolling over conventional wisdom. Me, I’m pretty jacked up waiting for what this means for Twitter. Go Giants! @stevegillmor, @scobleizer, @kevinmarks, @jtaschek Produced and directed by Tina Chase Gillmor @tinagillmor |

| Algorithms/Data vs. Analysts/Reports: Fight! Posted: 04 Feb 2012 10:11 AM PST  Quick, what’s the second most traded commodity in the world, after oil? Sorry, no: it’s not coffee. In fact, while hard data is scant, it may well be — of all things — carbon. No, really. According to the World Bank (PDF) , the global carbon market was worth a whopping 1.42 Facebooks US$142 billion in 2010. Mind you, it’s not like container ships weighed down to the gills with graphite are crossing and recrossing the Pacific every week. What we’re actually talking about here is the trade in carbon offsets, ie, the absence of carbon. Very Zen, no? Techies should be comfortable with this notion; I seem to recall spending less time studying electrons than I did “holes,” ie their absence, while acquiring my EE degree… Anyway, where there’s a $twelve-figures market, there are startups fighting for a share. In particular, there’s a battle on to see who will be the primary aggregator of carbon-market data. On one side, dominating the market, I give you the Goliaths Point Carbon, a tentacle of the Thomson Reuters kraken, providing “independent news, analysis and consulting services for European and global power, gas and carbon markets,” and Bloomberg New Energy Finance, doing much the same. On the other, I give you plucky little David eCO2Market, a Paris-based startup with an algorithmic sling. Point Carbon and BNEF crank out tomes and tomes of research analysis and offer subscription-based information tools. eCO2Market dispenses with weighty reports, and disintermediates analysts and researchers. Instead it tries to build up the biggest, most thorough, and most up-to-date database of carbon-market information, and then gives its users algorithmic tools to search, slice, dice, and organize that data themselves. The more users pay, the better the tools. (They have a free tier, too, if you’re a data geek who wants to play with what they’ve got.) “It’s our job to take this incredibly convoluted carbon area and put it into a nice little package for investors, environmentalists, everyone, and make it as easy as possible to find projects and their participants, buy credits, or make an investment,” says Chris Draper of eCO2Market. For instance, solar-power company ToughStuff uses eCO2Market’s data to find early-stage solar projects who might be ideal ToughStuff customers. It’s anyone’s guess whether they’ll thrive. The carbon market is in something of a fraught state right now: aside from the embarrassing theft of millions of dollars worth of carbon credits by hackers a year ago, what the World Bank delicately refers to as “regulatory uncertainty” — ie the stalled attempts to cement a successor to the Kyoto Protocol — means that the near-term future is at best uncertain. On the other hand, this year should see the launch of the Western Climate Initiative, a cap-and-trade system involving California, Manitoba, Ontario and Quebec; and in the long run, though, cap-and-trade carbon markets are probably a growth bet. Either way, eCO2Market is an interesting example of a small startup disrupting an information market by replacing human-written research and analysis with big-data aggregation, algorithms, and visualization. The optimal solution probably features both…but it says here the scale will tip further towards the latter with every passing year. Image: Global bubble map of carbon projects, from eCO2Market. |

| You are subscribed to email updates from TechCrunch To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment