Sponsored

The Latest from TechCrunch |  |

- Reaching 10M Downloads, And The Guerrilla Marketing Tactics We Used To Get There

- Horology Goes The Crowdfunding Route

- Startup Life In India’s Organized Chaos

- Think Hiring Is Tough In The Valley? Now Europe Joins The Talent Wars

- HTML5 Work Splits Into ‘Living’ And ‘Snapshot’ Standards. Developers Need Not Worry, Says Living Standard Leader

- The Ribbit Rollercoaster: A Founder’s Story From Concept To $105M Exit

- Forget LeBron and Durant: Bringing In Zuckerberg, Dorsey and Co. For The Olympic Tech Dream Team

- More Problems For Apple In Portugal? Apparently It’s Getting Sued For 40M Euros By A Reseller [Report]

- FoundersCard Adds Bonobos, Trunk Club & More Airlines To Its Private Membership Club

- Getting Rich By The Numbers, A CrunchBased How-To

- Viacom, DirecTV, And The Future Of TV Blackouts

- Review: Graham Chronofighter Oversize GMT Watch

- Apple’s App Discovery Lead On Google Is Shrinking, But Mobile Publishers Shouldn’t Be Too Worried

- Hulu Updates Video Player, Adds 10-Second Rewind And Easier-To-Use Settings

- Gillmor Gang: Or Are You Just Glad to See Me

- Cloudwashing Failed – Now We Need New Metaphors

| Reaching 10M Downloads, And The Guerrilla Marketing Tactics We Used To Get There Posted: 22 Jul 2012 09:00 AM PDT  The day my app (AutoCAD WS) crossed one million downloads on the App Store, the first question that crossed my mind was how did I ever end up doing marketing? I was a techy product manager and never imagined myself in marketing, until my app was in a life or death situation. The startup I co-founded (which was later acquired by Autodesk) developed a CAD B2B app for engineers. After launching our product, we started marketing it by the book – crafting our positioning and working with a PR agency to approach bloggers. This didn't work. We went at it a second and third time – tweaking our positioning and web site once again, adding more product features and writing to more bloggers. Didn't work – again. I gradually came to an understanding that when competing with hundreds of thousands of other apps for attention, marketing is not just another ingredient in an app's success. It's the main one. We were a small team with a very limited marketing budget, so we declared war the only way we knew how – as engineers and UX designers. The following months we left what we knew about traditional marketing behind and started exploring new and creative ways to reach new users, and like the engineers we were – measuring each step along the way, down to the last click. These days the product is celebrating 10M downloads worldwide with customers from dozens of Fortune 500 companies. Here are some non-traditional tactics that helped us get there. Making a Vertical App Horizontal (or in other words, making a boring app interesting)Our product seemed to us like the most exciting app – changing the way engineers and designers work together. Sadly, not many writers shared our excitement. We were classified by the press and media as a 'niche' app and were having a hard time getting coverage. The first big marketing step for a vertical app to admit that it is one. Your killer aquarium manager, Classical music SongPop or wood chopping app won't interest the average person, but to get to your vertical users you'll have to use mainstream channels. We managed to get out of our 'niche' by working hard on creating funny, quirky and even touching content. Instead of trying to pitch our product and new features, we tried to make people laugh and feel something about it. Here's one example where we worked hard to make our app more interesting: when launching our Android version we decided to use the one thing we knew Android users love best – Android. We created 'Andy the Engineer' as our mascot, and the video we created for the app showed an architectural version of Andy with plenty of 'Andy' jokes. That video got over 1M views, an amazing number considering we're talking about a video for a CAD app. Those kinds of materials got us into the main Android blogs and got Android fans to tell their designer friends about us. Getting Customer Stories and Testimonials – The Guerilla WayFrom day one we heard beautiful stories about how users were using our app – from building theme parks to oil rigs. But every time we approached companies asking them to write their story – Legal and 'what's in it for me' got in the way. I decided that instead of contacting users I'll try going the other way around and work with those who contacted us. When receiving support requests over email from users coming from interesting companies, I actually picked up the phone and rang them. Yes, imagine sending your feedback and having the founder of the app call you 10 minutes later. After talking to users about their request and learning how they were using our app and how it helped them be more productive, I asked their permission to write about it. In less than two weeks we had amazing stories about designing mines in Brazil, a new children's hospital, musical theater hall and many more. Small tip: the sooner you call the more likely you are to get good cooperation. I had the "One hour" rule, calling users no later than an hour after receiving their email. Create a Direct Channel to Your Users – You'll Be Thankful During Your Next Cloud OutageEvery successful startup has its downtimes, broken versions and awful bugs, and that's exactly when you'll want to directly communicate with your users. Requesting users to sign-up using their email was one of the hardest product decisions I ever made. We lost about 10% of users during sign-up. It paid off though – we had one long downtime following a new release and another one when Amazon had an extended outage. At that point a lot of users don't check your blog or twitter account, but instead go directly to the App Store – to rank your app with a one star. Using email and in-app messages we were able to share the problem with our users directly. Unexpectedly, not only were most users supportive, we even saw a pickup in usage after notifying users that everything was back to normal. Watching your 4.5/5 star rank you've worked so hard for sink in just a few days due to a tech problem is every app developer's nightmare. Turn On All Engines, We're Going Global!It doesn't matter if it's a free or paid app – when playing in the mobile arena it's a numbers game. Every download counts, whether it's coming from NY or from a village in China too small to be shown on Google Maps. Localizing the app was the first step, but the 2X increase we saw in our numbers came from localizing our marketing. We started by localizing every pixel of content on our app store page. It's not enough to translate the app description – we wanted a Russian user to see a screenshot with a Russian user name in it, a Brazilian user to see drawings in Portuguese and a Chinese user to see the app's contact list with Chinese service email addresses. We worked on different marketing kits for each country – sending local bloggers a summary in their own language, images of the app relevant to their readers and full download numbers for their own country. Small tip : we stored each device's language to send users newsletters in their own language. [Some of the imagery used on our international campaigns - straightening the leaning tower of Pisa for our Italian launch and pulling out our app from a Matryoshka for our Russian version] Marketing is all about telling your product's story, and it’s difficult when that story is a bit more complicated than photo-sharing. Our app has always been an outsider – taking a 30 year old desktop product to mobile and into the cloud doesn't make you the most popular kid at school (neither the mobile school nor the CAD one). We fought our own battle with what we felt was right for us and achieved the results we wanted. With hundred of thousands more of these “outsider” apps finding their way in the App store, I hope to see even more marketing wars fought in unique ways and with stories told in their own voices. And downloads, lots and lots of downloads. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Horology Goes The Crowdfunding Route Posted: 22 Jul 2012 08:26 AM PDT  To date, there have only been a handful of watch projects on Kickstarter, and of those, there really have only been a couple that grabbed my attention. But here’s an interesting one that just popped up on PleaseFund.us, a new crowd-funding site that looks to be a direct Kickstarter competitor. Terranaut Watch is bringing an oversized (50mm) watch to market, but one that they feel will “wear” signigicantly smaller, due to the lugs being hidden and the 13mm case. I’m not the biggest fan of watches over 46mm – but if their design choices work out, this could be an interesting one to keep an eye one. The most interesting thing, however, is that they are crowdfunding the manufacture so you, the buyer, and pony up if you want the piece. So, why crowdfund? They’ve actually got some intriguing developments along with the watch that they’re shooting for. First off, they want to create a carbon fiber case – which, if you ask me, is a pretty nice upgrade over plastic cases. Second, they’re working to develop a glow-in-the-dark strap. Not that the strap itself will glow in the dark, but that the stitching will. I’m a sucker for anything that lights up a watch in the dark, so this is really intriguing. Plus, this 26mm strap should be nicely padded, so it looks like it would be a comfortable one. It’s a Citizen/Miyota movement, and has had some components painted to keep things looking nice on the inside of the case. They had initially considered a Swiss quartz movement, but of the two they tested, one broke, and the offered a horrible user experience. The watch itself looks to come in four variations including a choice of bezels (stainless or black) and dials (60 second or 24 hour layout). They’re looking for £3,500 and your pledge is refunded if it doesn’t fund. The piece costs £175.00. There are also cheaper funding levels on their project page, so you can decide what level to get in on before it closes in August. You can also read up on their website, or follow them on Twitter. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

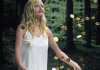

| Startup Life In India’s Organized Chaos Posted: 22 Jul 2012 08:00 AM PDT  Editor’s Note: The following is a guest post by “entrepreneur around the world” Nir Eyal. In this post, Eyal explores some of the challenges of managing a start-up in a country where disorder is an integral part of the way the country runs. "India is a woman", so told us a young Indian a while ago in Goa. We were sitting in one of the countless restaurants scattered along the Goan beach and heard for the first time a phrasing of India in one sentence that actually explained something about it that we always had a hard time with. "You must understand, in India the female energy is the dominant one". At first, considering the level to which Indian women have to cover themselves in public and the prevalent focus on wedding and children, it sounded a bit peculiar to us. But the young woman went on to explain: "What I mean by feminine energy is… as in the west, in countries like Germany, everything works on masculine energy – order, reason, precision. In India everything operates on feminine energy – feeling, flow. Everything is emotional not logical." Putting aside the specific characterisation of what is feminine and what is masculine, that statement as it relates to India, just clicks right in. It is something that is very important to know, especially when you try to do something as logical as working, managing a business, from inside India. Disorganized OrderAt times is seems like nothing here works efficiently or even in a conceivable manner. If one boat takes you across the river, it will not take you back. A different boat takes you in the opposite direction. Public transportation will not arrive on time. Electricity will work when it feels like it. If it says that a road leads to one place, it does not contradict the fact that if you take it you will get to a completely different place. If a store is decorated with electronics equipment signs it doesn't mean it is not a deli. And if they say that there is WiFi, it usually means that there isn't WiFi just now, but maybe tomorrow. That's why keeping a relatively continuous Internet connection in India becomes a journey in and of itself. In a business in which Internet access is the access to the business itself, it is a serious issue. Sometimes I imagine that all the communication in India is done by scribbled-on paper notes sent in shabby auto-rickshaws across the Indian roads. Just every once in a while, for my sanity’s sake. It is hard to understand it otherwise. That is also why most answers from tourists, to any question you might ask here, will be: "It's India". This giant sub-continent, comprised of many small states, is having difficulties with issues such as consistent cellular policy. Along the way we meet many people with small colourful collections of Sim cards from all possible cell-companies stashed in their wallets – six, eight, ten and up. Many people need so many Sim cards, because each Sim gets reception in a different and unexpected part of India. Also because the operating of a Sim is a cumbersome and awkward feat that includes filling out all your personal details on a piece of paper that has to physically reach the company offices in god-knows-where. Often the paper is lost on the way or the company simply decides that your personal life info is not sufficient to allow you a cellular service and block it. It is not surprising that Colnect already has many Sim card collectors registered under the phone cards category. That is what happens when you combine feminine energy with good old fashioned British bureaucracy. Welcome to GoaWe arrived at the beach laden Goa, to the quiet Ashvem Beach. We bought two new Sim cards, In addition to our previous one that was blocked, getting only Hinglish (Hindi+English) automated messages. Trying to operate the old Sim repeatedly led to the same pre-recorded customer service lady, that always answers in the bemused tone of a middle aged woman sitting at home with a glass of red wine. She is very pleased to tell you – that the card no longer works. India is a long path, full of curves and turns. Sometimes a turn could be there purely for the humor of it, because it doesn't lead anywhere. Like their infinite adorned gods, their endless elaborate myths, the incredibly detailed temple walls, everything is there for the beauty of it. And that is a point one must understand. Maybe there is a lesson there too – to do things for their own sake. But if there is a place you need to get to, you will encounter trouble. Now we are sitting on the rooftop of the apartment in Ashvem. Goa in general and the area of Arambol beach in particular have been transforming into little Moscow for a while now. Russian tourists flock here in great numbers on every bathing season, every business on the nearby coast line is decorated with Cyrillic letters and the beach itself is mainly decorated with minimally dressed Russian women in pseudo-hippie attire. In Goa we chose to reside through Couchsurfing. To those who are unfamiliar with the concept, it is a website where travelers host in each others' homes all over the world. This time it was with a group of young Russians that rented an apartment near the beach. A cheery but Russian-speaking-only bunch, which was joined by a few more guests: two French girls, a German guy and an (US of A) American guy. The rooftop has WiFi. There might not be a cable connection in Goa but there is a wireless one. Work is flowing onwards. Bugs on Colnect are getting fixed while real life beetles and all kinds of other insects are lazily buzzing about. Below the building we can hear a roaming group of wild hogs calling out their mating calls while Frognector stares back at them. Between sunsets on the beach, which is very much like an extended coconut-palm filled version of the beach in Tel Aviv, is seems surreal to wonder about how things at home are, and what a community spread all over the globe of stamps and coins collectors will be needing right now. Nothing beats work in motion. Image: Zubin Shroff | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Think Hiring Is Tough In The Valley? Now Europe Joins The Talent Wars Posted: 22 Jul 2012 06:00 AM PDT  Despite some of the froth being blown off following the rocky Facebook IPO, it remains the case that talent and hiring are a big issue in the Valley. And you may not know this, but for a long time Europeans looked onward to the U.S. and thought to themselves, “Ha! We have plenty of room left for growth! And plenty of talented, educated people! Mwah ha ha ha !” Ok, Ok, let’s leave aside that many of them wouldn’t themselves mind moving to the warm climes of Palo Alto and the rest… Instead, let’s concentrate on what actually happened next. What happened next was a good two, three of years of growth. And, we’ve seem the rise of some significant European originated companies such as Spotify, SoundCloud, Badoo, Fon, Moshi Monsters, Shazam, Wonga, Huddle … and the list goes on. But the honeymoon is definitely over. In the last few weeks and months I’ve been hearing plenty of tales of woe from European entrepreneurs having real problems finding the people they need. It looks suspiciously like the hiring wars have hit Europe, as they have the Valley. Admittedly, perhaps it’s a nice problem to have. It’s clear from signs like this that there are real businesses growing in real ways out there. And they need people, now. In other ways it shows there are systemic problems in the talent pool globally right now, as the world switches gears into a technology-powered future in its quest to escape the recession. One very simple illustration of this trend came this week when London/U.S. startup Huddle performed a typically combative stunt (the company routinely pokes fun at Microsoft Sharepoint) by placing advertising billboards outside the London offices of Yammer. Huddle went in all guns blazing, mocking the ability of Microsoft to incorporate the startup culture that built Yammer. But Yammer’s team was having none of it. Yammer EMEA General Manager Georg Ell simply tweeted

Cue mocking picture: These kinds of antics are not very new in Silicon Valley. But let me tell you, when we are talking about startups, they are pretty much brand new for London, and for Europe. While it’s all a nice illustration of the good-natured rivalry out there, its also symptomatic of the underlying problems startups are having. As Greg Marsh, CEO and founder of OneFineStay told me, at a European Executive management level things really start to thin out: “There just aren't enough capable and proven senior execs in Europe with Tier One experience in tech. It's a very, very thin market in some functional domains.” Joshua March, founder of London-based Conversocial agrees: “Hiring is a nightmare…however, the challenge for us now is in the sales side – turns out there aren’t a lot of high quality, hard working sales people with good SaaS experience in the UK / London. We’re really working on scaling our sales up but hiring really good salespeople fast enough is proving a big barrier in the UK.” That said he said it’s still possible to get developers. “Salary is not too much of an issue I don’t think… there are just a lot fewer fully-funded start-ups here.” He also says he sees developers moving out of the big banks into startups. Andrew Scott, currently working on a new stealth mode startup, says there is less a dearth of talent “but it is hard to justify the amounts those who know they are the best demand, especially when you’re bootstrapping or pre-Series A.” Another issue of culture that was pointed out to us was options. European staff typically have little experience of dealing with the share options culture so common in the Valley. Says Scott: “Many European developers/candidates are not seemingly able to comprehend the potential value of Share Options (even if generous). Or perhaps they are less unable to comprehend them and simply don’t believing in the ability of the options and the start-up to make them rich.” “There are too few visible examples in Europe of exits doing this for people much beyond the founder(s),” says Scott, who plans to allocate a large chunk of the company to staff to try and break the hiring dam. Tine Thygesen, founder of Everplaces in Copenhagen has a different view. She thinks plenty of people are looking for opportunities outside of the Valley: “We’re doing well getting people, we even get a fair amount of applications from the US and other countries, so we’re actually not experiencing this recruitment issue…” It may be that Copenhagen has its merits over an anonymous office in Mountain View, or event off Market street. “We make a big deal out of being visible and talking about our how it is to work here,” she says from a sunny Copenhagen. However, there is a different issue arising here: inflated salary expectations from other parts of Europe when trying to lure staff. “The biggest issue we have encountered is that getting people in from eastern Europe is not working well anymore, neither fixed or on contract agreements,” says Thygesen. “The salary expectations [in the East of Europe] are vastly exaggerated, so developers now expect more than our local developers… sometimes even in real terms. And certainly in terms of what you get in terms of output from them, comparatively speaking. I expect that the “good stories” of what the top devs get in Western Europe are travelling fast, so now new entrants to the game think they can get that kind of money.” Once again, Europe is feeling the heat of both an external market pull (the U.S. and elsewhere) and internally between East and West. Has the Berlin Hype Machine backfired? And then there is Berlin. As TechCrunch identified at least 4 years ago, Berlin was poised, in 2007/8, to become a fertile ground for startups, with a young, creative population, and few incumbent industries. But the hype has escalated to such a point that you now find CEOs frustrated by the noise. Indeed, it’s got to the point that the CEO of 6Wunderkinder was recently quoted as saying “Berlin needs less hype, more focus.” Speaking with entrepreneurs there, one realizes that Berlin’s hype may be starting to backfire. While London has a huge population of 18 million people from where talent can often be drawn, Berlin’s 6 million population is putting strains on the hiring race. As one senior startup executive there told me: “Berlin is tipping over. I know a startup founding CTO who was hired away to a new company after it got a funding round, and ended up on huge €180,000 salary. There are just too few people chasing too many highly funded jobs. A PHP dev with 2 years experience is getting a €100,000 starting salary. Another startup I know had three sales chiefs poached in 6 months by Rocket Internet.” In fact it’s got so bad, he says, that “some startups are not talking anymore amongst each other.” There are even tales of some companies moving away from Berlin to avoid the hype. Another contact emailed us to say: “”One Startup moved their Dev people to Frankfurt! Now you don’t know Germany but Frankfurt is BAD … that is DESPERATE “ We’ll leave that for you to interpret. But suffice it to say, the recent launch of a new accelerator in Hamburg was accompanied by background briefings that suggested it was glad not to be inside the hiring wars of Berlin. That said, Berlin continues to grow. Wooga, the social games company which is breathing down Zynga’s neck with at least three of the top ten games on Facebook, recently trumpeted the watermark of 200 employees from over 30 different nations now working there. Quite a contrast to its four employees of 2009, and a trajectory which was probably helped by Berlin’s increasingly international culture. But, it’s clear from the significant number of voices across Europe that hiring issues remain the same. Few companies can get enough people. Few can get the right people. Everyone is looking for huge passion. And sometimes, things disappoint. In many respects the issue comes down to solutions which are far beyond the reach of most startups. Namely, the immigration policies of the host nations. And it’s the most enlightened nations, realising where the next wave of growth might come from, that are meeting this call. Within Europe’s wide and pretty open Schengen agreement, that’s likely to stand in its favour. Outside of it, things get tougher. The only questions that remain are these: Can Europe retain the talent? Can it ultimately meet the demand of its own startups before other countries lure away the best and the brightest? I guest we’re about to find out. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Jul 2012 12:58 AM PDT  It’s not often in the mobile world that you hear of a split in standards development that doesn’t make you groan thinking of the complications that it will imply moving ahead (hello, Android!). But a new development for HTML5 will apparently do just that. The Web Hypertext Application Technology Working Group (WHATWG) and the World Wide Web Consortium (W3G), the two bodies working on HTML5, are parting ways with WHATWG taking charge of an evolving, “living standard” and W3C working on a more static “snapshot.” Some are already raising the issue of forking (“Overall this doesn’t seem to be a good development. It will no longer be possible to say exactly what HTML5 is,” writes developer Ian Elliot), but the head of WHATWG, Ian Hickson, told TechCrunch in an email exchange late last night: ”We’re probably going to make a lot more rapid progress now.” (Quick background: HTML5 is the web-based, non-native mobile web protocol championed by Facebook, Opera and other developers for the promise of developing apps and other mobile content that works across different operating systems without significant customization or special code work. It still has a long way to go, though, before it’s as functional as a native platform like iOS or Android.) The news of the split was described earlier this week by Hickson in an open letter on W3C’s forums, where he notes that over the years, the two sides have already been working on different parts of the standards. That separation of duties has meant that the two sides have “slowly slightly forked”, and now that has been formalized into an administrative split: one person responsible for editing the W3C HTML5 Canvas and specifications (yet to be named), and another editing the WHATWG specification (that will be Hickson, whose email signature tagline is “Things that are impossible just take longer.”). We contacted Hickson to answer a few questions about what this might mean for developers, and for us users in terms of getting an increasingly better experience out of HMTL5 web apps. This is an issue for companies like Facebook, which in April revealed it had twice as many users of its HTML5 apps as it did its native iOS and Android apps, but that these users were limited in what they could do because of Apple and Google’s slow progress on the standard. An interesting thing Hickson pointed out to me was that there is value in what both sides are doing. His side will be looking to put in more functionality, while W3C will be looking to make this something that can be appropriated by the tech world on another level: in the case of patents and contracts. Here’s the Q&A we had late last night:

On his side, Hickson says he plans to keep a close eye on the HTML working group’s deliverables, and will be taking into account any work they do. “There’s no guarantee that everything that the W3C does will end up in the WHATWG spec; the higher priority is that the WHATWG spec represent what implementors, mainly browsers but also editors and validators, implement (or will implement). So obviously if the W3C spec says something that doesn’t match “reality” it won’t make its way into the WHATWG spec.” He points out that this “isn’t an entirely academic concern, but hopefully it’ll be rare.” We’ve spoken with one developer to get his take on this and he concurs with Hickson that the main priority here is what browser leaders will do, although he also thinks that “separation rarely indicates things are going well.”

This seems to be the crux of the situation: navigating through the choppy waters of progress while making sure everyone stays on board. We are reaching out to both Facebook and Opera, two of the bigger names that have put a lot of effort into developing content on HTML5, to get their take on the situation. [Image: NCBrian on Flickr, HTML5 logo] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Ribbit Rollercoaster: A Founder’s Story From Concept To $105M Exit Posted: 21 Jul 2012 10:00 PM PDT  Editor’s Note: This is a guest interview by Bernard Moon, co-founder & CEO of Vidquik, a web conferencing and sales solution platform. He blogs at Silicon Moon. I met entrepreneur Crick Waters last year after hearing just a portion of his story and his road toward Ribbit's $105 million exit during an event in Silicon Valley. Soon afterward, I felt confident that I could learn from him and that his experiences building Ribbit would be valuable for Vidquik and our team. I finally got a chance to interview Crick and hear his full story, so I thought I should share this with other entrepreneurs working to build world-class companies. Bernard: How did the idea for Ribbit start? Crick: Ribbit started out as IDP Communications in 2004, started doing business as Duality in 2005, and finally become Ribbit in 2006. It was mid-2004. I had noticed that companies needed phone features for individual, company-specific, use cases that couldn't easily be met with traditional telco infrastructure. These features were inaccessible for three reasons: they required purchase of racked equipment and telecom connections, were sold in bundles at very high per seat prices, and they could not be triggered or accessed via web services. I realized that if the features of telephony services could be disaggregated, hosted as a cloud service, and be made accessible via web services; then these phone features would become "software" to developers making possible a whole new market of high-value applications. The first application was conceived of late in 2004 around the idea of "never miss that [buyer's] call." I put together a PowerPoint of the product idea, cold called several newspapers (this was, after all 2004 and people still used classifieds), and convinced the San Francisco Examiner to introduce "never miss the call" as a feature built into all of their classified online and offline ads. The Examiner would pay IDP Communications five dollars per ad. They loved the idea and a contract was drafted up and sent to Philip Anschutz's CFO in Denver for approval. At the same time, Anschutz created a new national marketing VP position to oversee all the Examiner properties across the country. I got a heads-up call from the consulting firm in Florida that was helping me with introductions in the newspaper and advertising industries warning me that the person who had been tapped for the job was old-school, unlikely to understand the technology, and would probably kill the deal. Sure enough, he was and he did, and the two executives I had been working with at the SF Examiner both quit within weeks. Bernard: Wow. Horrible. Crick: It was pretty devastating, the loss of momentum was a definite setback. Worsening the setback was that the co-founding CTO I had been working with, Bruce Young, got a killer job offer to go work for a company called LignUp. The opportunity for him was really too great to turn down and though I understood and supported his choice, the double-whammy had me counting sheep logarithmically. I was without customers and without a CTO. Bruce, though, had introduced me to John Appler. John had been helping me on business development with the Examiner. John, in turn, introduced me to Ted Griggs, who was founder and CEO of a company called Syndeo, where John had previously worked. Ted and his team had been funded by Redpoint and a consortium of cable industry companies to the tune of $98M. Syndeo, at one point a 150-person company, had built and deployed a DOCSIS-based voice over IP soft switch for the cable industry. Though Syndeo had developed award-winning technology and had international operating deployments, the market had moved on without affording Syndeo an exit. The company had trimmed down to its founding team and was looking for ways of leveraging its intellectual property with its remaining funds. Syndeo's technology was much more advanced than what I had anticipated having to work with to jumpstart IDP Communications, and the Examiner deal had left me free to pivot. So when I was introduced to Syndeo, Ted and I were able to put our heads together over a potentially faster-bigger-stronger plan. "Okay," we thought, "let’s see if we can take the IDP Communications concepts and re-apply them with the more powerful soft switch rather than using Asterisk or LignUp (where Bruce Young was). We spent nine months iterating on a whole set of ideas. From April 2005 onward, we took a number of turns. One of which was pursing an enterprise peering exchange for MCI, another was pursing a dual-mode phone strategy using intelligent call routing to seamlessly hand-off calls between mobile and fixed endpoints. It was this idea that led us to file a dba form as "Duality" and IDP Communications became Duality Inc. The Duality team eventually arrived at a revised business model and a product that we would call Mobi-Link. Mobi-Link converged your cell phone number with your fixed-line number (we still had these in 2005) allowing calls to be made from and received with home or office phones, VoIP phones, instant messenger clients, and with any Internet browser. Mobi-Link came with a networking platform, call diversion and re-direction features, a graphical UI, contact management, and a whole bunch of stuff that we take for granted in many applications today — but in 2005 were kind of radical. In December of 2005, we started getting nibbles from the venture community. Recurring interest. Bernard: You told me that you started fundraising in March of that year, and then you stopped at the end of the year? Crick: Right. We were working tirelessly at fundraising throughout 2005. Toward the end of 2005, now a year since Ted and I had started talking to the finance community, we were still unfunded. Fortunately, Ted was able to reign in some money by licensing a portion of Syndeo's technology to another firm. Those licensing fees gave us the runway we needed to fund development of Mobi-Link. Bernard: Did that work? Did you actually use this Mobi-Link beta product to attract funding or did you find funding through some other means? Mobi-Link was a functional demo and was a very useful proof of capability and concept, but it wasn't the driver behind our first funding. We had never really released Mobi-Link into the wild. Yes, we had a website up and one could register for the service, but we'd done no marketing or launch activity. We were pretty much in private beta mode. A few investors were following our progress, but none stepped up to the plate based on Mobi-Link. It was social networking and serendipity that were the origins of Ribbit's funding. Even serendipity has a path and the path to Ribbit's first round of funding started when my son was a year old. My wife made plans for our family of three to have breakfast with a friend of hers with whom she had worked at Excite @Home. Her friend, who also had a one-year-old son, would be bringing her husband, Gilman Louie. I asked, "Do I have to go?" and my wife said, "Yes, you have to go." Gillman, who was the CEO of In-Q-Tel (CIA's venture capital arm) at the time, is rumored to have asked his wife the same "Do I have to go?" question. Neither of us, apparently, saw the latent potential of the pancake breakfast. We met at the Millbrae Pancake House sometime in late 2003 or early 2004 for an uneventful breakfast of one-year-olds and their parents. It wasn't until halfway through 2006 before the pancake potential started to play out. In 2006, Gillman left In-Q-Tel and together with Stewart Alsop who left NEA, formed a new firm called Alsop-Louie Partners (ALP). As the two of them were starting up ALP, Stewart, whom I didn't know, blogged about how he couldn't find a phone system that met the needs of small businesses. Stewart had been with NEA. He knew technology and he knew the Vonage guys. So if he couldn't figure out how to get a phone system that would work for him then he was a guy I needed to talk to. So I wrote to Gillman reminding him of our pancake breakfast of two years prior and asked if he and Stewart would meet with me about Stewart's blog. Gilman and Stewart were game, so I set up a meeting at Gilman's brand new office in Levi Plaza. Ted was focused on code writing and asked, "Do I have to go?" I said, "Yes you have to go. Even though this is a market research thing, who knows? Maybe they'll raise a round and fund us some day." So we drive up from Mountain View and snagged a clutch parking space right along Levi Plaza. It's all metered street parking up there with aggressive parking police driving around all the time. So we waited until just before our meeting start time to go in so that the maximum one-hour of parking time would cover our hour with Stewart and Gilman. We went in entirely focused on what Stewart saw as the problem needing to be solved in small office phone systems. ALP, remember, had just formed and had no fund yet. They barely had furniture back then. So we interviewed Stewart and debated Vonage as an investment. Before long, Stewart and Gilman turned the table on us – challenging us with "are you good entrepreneurs?" They're both smart, connected, and were pretty aggressive with us. Even though they had no funds to invest, we told them what we were up to and showed them Mobile-Link. A few minutes before the end of the hour, I started packing up since our parking meter was about to run out. Getting a parking ticket wasn't something I could go for – my second child had just been born and neither my wife nor I had an income – and since APL hadn't yet any funds to invest… So I thanked Stewart and started to make a polite exit. Stewart said, "You can't leave yet. I'm like, "My meter's running out – and you know how aggressive the parking police are here. I've got to go." Stewart, reaching into his pocket and pulling out a handful of quarters said, "You can't go yet. Here. Go put money in the meter, and come back. We haven't talked about the terms yet." "The terms?" I asked (politely laughing), "Don't you need a fund first?" He says, "Don't worry about that, we'll get a fund." True to his word, Stewart wrote up a term sheet for funding contingent on a partial close of ALP's first fund. There were a lot of things that happened between then and funding, but in the end, Ribbit helped ALP close their first fund and ALP helped Ribbit by leading our series-A. So it wasn't until August 2006 that Ribbit was actually first funded. Bernard: August 2006? So how long had it been? When did you actually leave AT&T to go on this whole journey? Crick: The end of 2004. Bernard: So it was a two-year journey until you got funded. Were there hesitations to throw down the whole entrepreneur bag and just go corporate? Crick: Yeah. I had a one-year-old at the time and my wife was pregnant – I was a working stiff like everyone else. Even though I had always wanted to do my own thing, I agonized over whether to start Ribbit or not. David Krantz was very helpful and introduced me to a fellow named Dennis Haar, who was then CEO of Go Digital. I drove out to Go Digital and I met with him as a potential mentor. It was Dennis that told me, "There are two good times to start a company. The first is when you're young and have no family, you live off your family at home, and you can basically work twenty hours a day because you're nineteen. That's a great time to start a company. The second is when you've finished the corporate career path, you've got money in the bank, and your kids are grown and gone. You can downsize your property and afford to basically give all your time and wisdom to a company. Everything in between is a nightmare." Bernard: (Laughs) Crick: These words weigh heavily on you right? They did me too. I was in the nightmare phase of life (and still am for that matter!). I wasn't able to sleep for worrying about what I was going to do. I kept thinking about what Dennis (and so many other wise folks advised) and agonized over whether to go for it or to pull the plug. It was my wife that tipped the scale. She is awesome. She said, "You were miserable at AT&T. It is not you, so I don't quite understand what all this worry is. You MAY NOT stay at AT&T. Let me ask you a question. Let's say we go through this, and things don't go right. What does it mean 'they don't go right?'" I said, "Well, you know, you're out of work, we have two babies, we're paying for Cobra, we have a mortgage, and we have limited savings. If things don't go right, we'll run out of savings." She said, "What happens if we run out of savings?" I said, "Well, we basically sell the house, get the equity out of it and live off of that for a while in an apartment somewhere until I get a regular job. We'd have no house and no savings." She said, "You mean like where we were three years ago?" And I said, "Uh, yeah." And she said, "Well, that's not so bad. I don't know what you're worried about." Bernard: Really? That's awesome! What a supportive wife. Crick: She said, "All I want to tell you is that I don't want to be with you if you don't do this because you're not going to be happy unless you pursue your dream. The worst case scenario is not a bad scenario." Bernard: Right. Crick: So that emboldened me, and I took the early exit from AT&T. Of course there were endless follow-on periods of anxiety. The turns and tumbles – like when the contract with the Examiner fell through and my CTO resigned. Endless challenges. What do I do? How do I resolve that? Where do I go for technology? How do I find people? And there was investor on every corner telling me my idea was stupid. The good news is that it only takes one investor to like and fund your vision. (laughs) Bernard: That's so true. Bernard: Okay. So you got some money in 2006, you're building your product, so what happens next? Crick: So we're building what became Ribbit Mobile. In February of '07, I realized that Salesforce.com was the perfect application for our solution. So we built, between February and September of '07, Ribbit for Salesforce.com that we announced at Dreamforce 2007. It was really exciting because we basically had a two-foot by two-foot pedestal in the farthest reaches of the Moscone center – at the back of everything. I mean we were literally the third-to-last exhibit in the farthest corner. We were tiny little guys, tiny little money, BUT we had a line at our table all day, all three days. People loved it. We actually won an unexpected app of the year award at the show. In December 2007, we launched Ribbit. We flew around the country briefing the press and on December 17th, lifted the press embargo and pushed out our new web page. Don Thorson did a great job for us – we were even in the Financial Times – and still, Ribbit Mobile had not been launched. It was at DEMO 2008 on February 24th or something like it that we exposed Ribbit Mobile. There's videotape of me on stage at DEMO. I look really serious, like a Borg, with my headset on and eyes squinting in the lights. It's impossible to realize how hard it is to be relaxed on stage until you're on stage and realize it's impossible to be relaxed on stage (laughing). Bernard: I've seen it. I was thinking Max Headroom. Crick: So now we're going to start getting into how the company was sold. Frist we need to roll the clock back and talk about how networking in 2004 led us to BT in 2008. Bernard: Okay. Crick: While I was still at AT&T in 2004, I was invited to an industry networking event by a company called Light Reading. Light Reading was a market research and publication firm. They invited a bunch of people to a Light Reading golf tournament down in Half Moon Bay in 2004 – which I attended with an AT&T badge, and made good connections with the Light Reading team. In 2005, I was again invited, but this time I was unemployed with Duality Inc. and the event was in southern California – not a simple drive over to Half Moon Bay funded by AT&T, but a personal investment in airfare, rental car, and hotel accommodations. This was a big commitment for me – and I struggled with the question of whether or not to go. One thing that tipped my decision was following through on an introduction to Tom Marcin who was Global Director of Telecommunications at DuPont. Tom had been supportive of Duality in many phone and e-mail conversations and would be attending the Light Reading event, so I decided to go to meet Tom in person and while making the most of the event. The conference itself was good, though uneventful. Afterward, some of us found ourselves together at the Santa Barbara airport waiting for our flights home. Santa Barbara airport has a little bar upstairs and I went on up to find a boisterous, red-faced, Brit talking loudly and inviting me to join the table for a beer. I sat down, introduced myself, and discovered him to be a technology scout, Rob Hull, working out of the Bay area for British Telecom. I eventually told him what we were working on and that we'd been funded. He took some notes and we went on about our businesses. When we released Ribbit for Salesforce a year later in September of 2007, I thought of Rob and called him again to meet for a coffee – something like, "Hey, I want to show you this thing. We're going to need a distribution partner for Ribbit for Salesforce in Europe sometime and maybe BT would be a good partner." We didn't talk about telephony APIs at all. In the meantime, BT had started a skunk works project building telephony APIs. By the time Ribbit announced its telephony API strategy at our coming out in December 2007, BT's scouting team already knew about Ribbit, so this was only incremental news to them. What really got BT's attention was when the BT API team started meeting with potential customers. Joe Black was the business development lead for BT's API group. As Joe described to me later, he would go to Salesforce, Oracle, and others to introduce BT's API business. When he did, these prospects would say things like, "Oh, you're kind of like Ribbit." Joe was irritated to no end as you can imagine. Who and what is this Ribbit thing? So the BT API guys talked to their technology scouting team asking if they knew about Ribbit. And of course Rob Hull did. So Rob set up a meeting. BT came to our offices, saw what we were doing, and grilled us. They sent architects and product folks to our offices over a period of weeks. We even met with the then CEO of BT Retail (now CEO of BT) and his direct reports – all of us thinking we were working toward a distribution agreement. At the end of one meeting with the API team, BT said, "We are either going to buy you or partner with you." We thought, "Sure," but didn't believe that buying Ribbit was a BT-like thing to do. We were wrong. Sure enough, BT came through with an offer to buy us – I think it was March or early April of 2008 – so only a couple of months later. Bernard: Sounds like there were some difficult decisions to be made. Crick: Right. There were: to sell or to grow the business. So now we do some math. We had $11M invested on a post-money valuation of $30M with ~$6M in the bank when BT came to us with an offer. We had no plans to sell the company. British Telecom flew in to San Francisco and we met at the Starbucks in the lobby of the Westin St. Francis. They offered us $50M. The terms of the proposal were a little non-standard and amounted to essentially buying out the VCs and leaving the Ribbit team members as employees of BT with the potential of a bonus payout of some form, after three years, for those employees remaining. Bernard: Amusing. Crick: The offer intent was heartfelt even though we knew that it wasn't really going to work for our venture team. We also knew it wasn't going to work for Ribbit employees who have a Silicon Valley view of employment and rewards. We told BT this and they took our feedback back to the UK. When we told our board that BT had made an offer to purchase us, the board wasn't thrilled. They were, in some ways, very angry that we'd even consider an offer of purchase since we'd just closed our B-round and were on a valuable track. Expectations were rather high… Bernard: Wait. They were angry that you were even considering…? Crick: Yeah. Put it into perspective. They'd just funded us and we were doing all the right stuff. From their perspective, we should be aiming for multi-hundred million or billion-dollar valuations. But an offer is an offer. You have to entertain all offers. We did some math on what I called the "buy it now" price. In other words, what would be a minimally acceptable and expected return to a limited partner (LP)? Typically an LP needs two and one half times their investment – minimum. With our recent $30M post-money close, that would mean $75M over our post-money value. So a minimum acceptable valuation of $105M was the threshold exit given where we were. Meanwhile, our board was like, "No you're crazy. You're going to be a billion dollar company, why would you do this?" Ted Griggs managed all the stress of this sell-build dilemma. There was high stress on all three sides of the conversation – BT, Ribbit, and VCs. The only way this could work was if our board agreed to the buy-it-now price of $105M and BT met this price with an all-cash offer. There could be no monkey-business in any quarter of the deal. The economy, in the mean time, was going kind of wonky. So we talked to the board and said, "If BT comes back at a hundred and five, we think we should take the offer given what it would take us to attain that same outcome, on a dollar basis, with subsequent rounds of funding." Our B-round funds were only going to take us through the fall of 2008. We knew that we needed to start raising a $20M C-round, including a global strategic investment partner, by the end of the year. And even with a C-round, we would still have to overcome all the execution and market risk to build a company valuation at hundreds of millions of dollars – and then again find an exit opportunity. So we told BT, okay, our buy-it-now price was one hundred five million dollars. Al-noor Ramji, then CTO of BT Design, basically the second in command of BT, flew out with JP Rangaswami and met with me and Ted for a couple of hours up in San Francisco. Al-noor interviewed us on a very personal level. He wanted to know who we were; what drove us; what were our visions and personal passions. In the end he said, "I'm authorized to offer up to one hundred million and I'm not going to play games. I'm offering you the whole one hundred. We can work out the terms together or you can go to lunch and write them yourselves." So Ted and I went for lunch to talk over our dilemma. $100M was very close to $105 – but not $105. We'd worked hard to get our board to agree to the $105 price and were uncomfortable considering something just 5% short of threshold from BT – a company with nearly $40B in annual revenue. We had a long conversation and concluded that fundamentally, we couldn't accept a one hundred million dollar offer because we, our venture partners, and our board, had been very clear that they didn't want to sell the company and would only consider an offer meeting the hundred and five million dollar buy-it-now price. After lunch, Ted and I went back and told Al-noor, "We really like BT, your vision, and we love the idea of being part of it, but we need a hundred and five. If you get to a hundred and five, here are our deal terms." We went over our proposed terms. Al-noor listened, said he was very disappointed, then got up, picked up his brief case, and walked out. I thought, "Oh no this is terrible." Ted and I thought we'd blown it. We were worried we'd left the wrong message somehow and as we drove back down the Peninsula, called Al-noor while he was still at the SF airport and reaffirmed our desire to work with BT, asked him to consider our request, and assured him and that we would talk to the board about his offer." Long story short, Al-noor was able to get BT to authorize the additional five million. When he came back with an offer of $105M, we accepted. By May 10th, we had accepted an offer and closed on July 29, 2008. Bernard: Okay. And this is a little bit more for the benefit of entrepreneur's reading this… So the size of that deal did it warrant any financial advisers? Crick: Only as an insurance policy. We were being approached by other suitors at the same time that BT was talking to us. AT&T was literally in my office as the BT offer was being accepted.. At ten o'clock in the morning on this same day, we were going to sign the "no shop" agreement with BT. So I'm looking at my watch as the meeting progressed with the AT&T guys knowing that we had about fifteen minutes before we were supposed to sign the no shop. Of course, anything can happen – and there was still risk that the no shop wouldn't be signed… so I waited out the hour. Now the AT&T guy says, "So, we're all set. You're going to come to San Antonio on June 6th to meet with Randall Stephenson (AT&T CEO), his Vice President of M&A, and a few other execs. We're either going to make an investment or buy you outright. You'll fly out on June 5th for the meeting." He senses my quiet and looks up at me for a response. I'm not responding because I can't. The clock is ticking. Only minutes to go. And he said, "So you're going to be there right?" I said, "I can't come." There's just this pause, this huge pause. He says, "I don't think you understood me. You have a meeting with Randall Stephenson and his executive team and they are either going to buy your company or make a huge investment in you." He pauses and I say, "I can't go to San Antonio to meet with your team." Recognition and awareness fill his eyes. He leans back on the legs of his chair and says, "No! Don't tell me! (he was steaming) Don't tell me it was the 'G' company!" "All I can say, is that I can't come meet with Randall and his team." Bernard: The "G" company? Crick: Yeah, the "G" company was Google. Because Google had been on a buying spree and previously bought what became Google Voice. Bernard: Grand Central. I see. And AT&T saw Google as a threat in 2008? Crick: Yeah. There was enormous speculation in telecom that Google was going to enter the voice market and undercut the incumbents. Ribbit's API model was a piece that Google didn't have and AT&T thought Google was going to buy us up. Bernard: Oh I see, interesting. Crick: So when you add up that we had just closed a B-round, were still well ahead of the value creation curve for Ribbit, had one or more telco's as potential acquirers, and that our eye had to be taken off of the ball to entertain the offer from BT, our board wisely insisted we hire an investment banking firm. Bernard: Because you had so many people in play. Crick: Yes. Because if something fell through with BT… You know if we were to set off one of the basic deal trip wires like failing to meet certain deadlines, not finishing due diligence on time, etc. we'd have already exposed ourselves and would have to act quickly on the momentum of the moment. The investment bankers were brought in to pick up the ball and go into motion if the BT deal faltered. If that happened, the "no shop" would be lifted and the I-bankers would be poised to shop the company. Bernard: You had them on retainer? Crick: Yeah. That's how it worked. We paid an up-front retainer for them to be prepared and ready for a deal falter. Bernard: And then they took what, five percent of the deal? Crick: No they weren't part of the BT deal economics. Bernard: Really? They didn't ask you for that? Crick: To be part of the BT deal? No, because they weren't involved with the BT deal in any way. They were in waiting, sort of guarding the door. They were basically back-up. Part of our strategy with BT was to be open about having I-bankers in the wings: that we were ready to take this deal to the market if anything didn't work. The idea was to make sure all parties were focused on getting the deal done. Bernard: I see. So if BT didn't work then the I-bankers would… Crick: Yes, so effectively an insurance policy. Bernard: That's great for fellow entrepreneurs to know. Inspiring and insightful story, Crick. Definitely appreciate your time. Crick. My pleasure Bernard. I hope there are some nuggets here that help others as they create their own start-up stories. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Forget LeBron and Durant: Bringing In Zuckerberg, Dorsey and Co. For The Olympic Tech Dream Team Posted: 21 Jul 2012 08:00 PM PDT  In one week, the Olympics kick off. When you think about it, they aren't so different from our startup world. How many pitches have you heard that include the phrase "dream team?" If you had to compare the startup world to one sports league, what would it be? I'd argue the NBA, where the best players leave school early to start their pro careers and work to join dynasty teams with other superstars. While it helps to attend a powerhouse school—a number of the entrepreneurs on this list attended Stanford, Harvard or MIT and the basketball players at Kentucky, Kansas, or UCLA—once you get to the big leagues, all that matters is how you perform. But the NBA has one great advantage over the startup world: the Olympics. Bringing together the best players in the league (who aren't hurt) on the same team together. It's thrilling to watch. Which gets me thinking—what if there was an Olympic team for Silicon Valley. Imagine the best players from Facebook, Apple, Google, Twitter all playing together on the same team. Here are the requirements: the entrepreneurs must be active in their companies, ruling out legends like Bill Gates and Steve Jobs, and the basketball players must be from the current 2012 U.S. roster, leaving out legends like Michael Jordan and Magic Johnson. We can save the '92 Dream Team discussion for another day. Sadly, this isn't the greatest possible roster, as some of the best players are hurt and missing from the squad. But it's a pretty damn good one: Carmelo Anthony (F, New York Knicks) : Steve Ballmer (CEO, Microsoft)Carmelo won a national championship as a freshman at Syracuse before being picked #3 overall in the 2003 draft by the Denver Nuggets. Following his otherworldly 33-point performance in the Final Four against Texas and championship, the sky seemed to be the limit for Anthony. While he has lead his team to the playoffs every season, he hasn't progressed past the Conference Finals and isn't a top tier player like James or Durant. Now, he plays for a storied franchise, the New York Knicks, which is underachieving and outshined by their flashier competitors. He is also known for having a bad attitude and a big mouth. Who does that remind you of? Ballmer is described in Vanity Fair's August expose as making "astonishingly foolish management decisions" at the company that "could serve as a business-school case study on the pitfalls of success." But he wasn't always underachieving at a talented team. He joined Microsoft in 1980 and won many championships early in his career. Knicks and Microsoft fans stick wearily by their team, but would trade their squad for most others on this list. Plus, don't you think Carmelo would love stack ranking? Don't pass me the ball? BOOM. Negative review. Speaking of passing… Kobe Bryant (G, Los Angeles Lakers) : Larry Page (Founder & CEO, Google)One of the all time greats, Bryant's talent is only surpassed by his work ethic. He jumped straight out of Lower Merion High School to the NBA, where the 14-time All-Star has won 5 titles and too many awards to list. He is obsessive about improving his personal game as well as team achievement. One thing matters above all to him: winning, and he always wants to have the last shot to win the big game. In August 1996, Page and Sergey Brin made their initial version of Google, while Bryant was preparing for his first NBA season. Since then, a combination of brilliance and hard work has led Page, and Google, to the top of the world. The two legends haven't won a championship in the past few years and face stiffer competition than ever as new stars rise and competitors add more talent. But only a fool would discount their talent and desire to adapt and win. Tyson Chandler (C, New York Knicks) : Kevin Rose (Angel Investor, Senior Product Manager, Google)Picked second overall in the abysmal 2001 Draft—the first pick was Kwame Brown, whose career has been like sour Milk (sorry for the Digg, Kevin)—Chandler has played for five different NBA teams. He's been traded four times and tried to be traded a fifth time but failed the physical. He has played for laughably bad teams (looking at you, Bobcats and Hornets) and won a title in 2011 with the Dallas Mavericks. He has top-tier talent but hasn't been in many good situations in his career. With the right teammates, he's a champion, but he can't carry a team by himself Rose has followed a similar path, bouncing around different startups, some good that never reached their full potential, some not so good. But when he isn't carrying the team himself, Rose is a champion. Counting Twitter and Square among his more successful investments, Rose has made billions as an angel investor. Now that Rose has joined Google and Chandler has joined the Knicks, we'll see if their supporting roles will bear more championships. Anthony Davis (F, New Orleans Hornets) : Marissa Mayer (CEO, Yahoo)Davis leaves the best college team in the country, Kentucky, for the worst pro team. After winning a championship in his only college season, he was picked first overall by the New Orleans Hornets a month ago in a much-hyped move. He comes in with savior-like hype, tasked with turning around a perennially bad team. He will be paid handsomely for his troubles, but if he fails he will be labeled a massive bust. Mayer, a graduate of another powerhouse, Stanford, was an early, major player in Google's early championships. On Monday, she left Google in a high-profile move to become Yahoo's CEO, where she is tasked with rebuilding one of the worst pro teams. And finally, they both receive way too much press for their bodies: Davis' unibrow and Mayer's pregnancy. Andre Iguodala (G/F, Philadelphia 76ers) : Andrew Mason (founder/CEO, Groupon)Iguodala is a great player, especially on defense, but suffers from being miscast as a superstar. His great talent is overshadowed by excessive expectations and he is criticized because of it. He is constantly surrounded by trade rumors, but keeps plugging away. Mason and his Groupon team are good, but not great. They had a good idea that took off and grew too quickly, and the expectations became unrealistic. Despite the distractions stemming from their IPO and unhappy investors, the company is working to keep growing and innovating. Both Igodala and Mason could benefit from a trade to a better team, where they could thrive under lesser expectations. LeBron James (F, Miami Heat) : Mark Zuckerberg (Founder/CEO, Facebook)Born six months apart, the most famous players in their leagues both fled the northeast for sunnier pastures, leaving behind a wake of criticism. They are fiercely adored and harshly criticized. Their every move, professionally and personally, is scrutinized. James was getting hyped in high school before he went straight to the pros. He's made immature decisions that have haunted him, but he finally won a championship this past spring. Dan Gilbert (the Winklevoss twins), owner of the Cavaliers, is still livid about James leaving. Now, he plays with an absurdly good team, brought together by one of the greatest geniuses in the game, Pat Riley (Sheryl Sandberg). His all-star teammates, Dwayne Wade (Sean Parker) and Chris "don't call me a velociraptor" "ok, you're an ostrich" Bosh (Chris Cox) won't be joining him on this squad, as they are sidelined by injuries. Finally, he has made top-level talent join him this offseason, with Ray Allen (Kevin Systrom) joining from a former competitor. If you don't know Zuckerberg's story, please email me and tell me how you found your way onto TechCrunch. Check back tomorrow for part two, where we’ll match the remaining six players and coach with their Silicon Valley counterpart. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 21 Jul 2012 07:33 PM PDT  Another legal tangle for Apple in Portugal? Just days after a consumer rights group in the country said it was preparing to bring legal action against Apple over the wording of its AppleCare warranty service, it has emerged that an IT reseller and distributor called Taboada & Barros is already suing Apple over claims of price fixing and unfair trade practices, asking for €40 million ($49 million) in damages. According to a report in the Portuguese-language Apple blog iPhoneTuga – citing details first reported in the Portuguese weekly newspaper Sol – the suit stretches back to February but seems to have only been made public now, in light of the action being taken by the Portuguese Association for Consumer Protection (DECO). Unlike the DECO case — which has a precedent in Italy, where Apple was fined $1.2 million over a similar matter — this lawsuit is less cut and dry. Taboada & Barros, which also controls a large Apple distributor called Interlog, alleges that Apple’s intentional restrictions on the quantity of products it distributes through third parties led to the failure of Interlog. And this has coincided with Apple getting more active in the country, it says:

Apple has a dedicated site for Portugal but relies on resellers for physical sales. A post on Portuguese business news site Economico, dating back to May 2011, underscores how demand has outstripped supply at resellers. With iPhone handsets, iPad tablets and other devices and peripherals not arriving after March (presumably due to Interlog failing), some claimed unfilled orders for devices like the iPad tablet. A source at TB, speaking to Sol, says that on top of restricting the flow of products to third parties, Apple renegotiated the margins that resellers can take on products down to 4 percent from a previous 12 percent. “Apple unilaterally established products, prices and quantities to be sold to large retailers,” it said. It’s likely that the margin reduction and lost sales over supply issues are both factors in the request for €40 million in damages. Given that in other countries Apple has played a strong role on the retail side, with its own direct presence in the form of physical and online stores, if all this is accurate, it should be unsurprising to hear Apple cracking the whip and attempting to bring more of the sales effort in Portugal under its wing. Regardless, coming as it does alongside the DECO action, even raising the issue of unfair practices can end up being damaging to Apple’s reputation in the country. We are contacting both TB and Apple for comment on this story and will update as we learn more. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FoundersCard Adds Bonobos, Trunk Club & More Airlines To Its Private Membership Club Posted: 21 Jul 2012 05:05 PM PDT  FoundersCard, the membership program bringing executive-style perks to entrepreneurs, is rolling out a few more perks today to add to its growing lineup. The company currently offers discounts on a number of products and services, including things like elite status on airlines (5% off Virgin America, 10% off Virgin Atlantic, 10% off Lufthansa, and 5-22% off Cathay), discounts with Apple, AT&T (10%), UPS (up to 32%) StubHub, TaskRabbit, and hotels, to name a few. The company, which celebrated its second birthday in January, was created by serial entrepreneur Eric Kuhn, who wanted company founders to have access to the same kinds of exclusive rates, elite programs and networking opportunities that have always been reserved for top execs at public companies. Along with the new perks being added today, FoundersCard is also announcing hitting 7,500 members as of this week. Here are the perks which just now arrived:

Currently, the FoundersCard program is $495 per year, or $295 if you’re invited by another member. TechCrunch readers/entrepreneurs can use the code FCRUNCH13 to get 40% off, if you choose to sign up. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Getting Rich By The Numbers, A CrunchBased How-To Posted: 21 Jul 2012 04:00 PM PDT  Editor’s Note: The following is a guest post from Sameer Al-Sakran. Al-Sakran is a data scientist and machine learning specialist who was formerly the engineering manager at Imeem. Hey kid, wanna get rich? After watching “The Social Network” for the third time this weekend, are you feeling ready to create something truly world-changing and make a billion dollars? Have you just finished off an MBA and are looking for a job slightly more glamorous than traveling 364 days a year for a Big 3 consulting firm? Are you getting hit up for co-founder gigs in between gigs making web pages for dentists and want to know what white-hot area you should get into, if you did decide to live the dream? We’ll you're in luck. We've gone through CrunchBase (which is basically a National Treasure, or at least a treasure trove of data), and tallied up how well various company categories have done over the years. IPOsIf you have your heart set on a public offering, get into chips. Semiconductors that is. A full 8% of these types of hardware companies in CrunchBase ended up in IPO. But, if you don't know a transistor from a Macbook charger, maybe try drugs? Biotech companies were second with a good 5% IPOing. If you're set on a software company, the common dictum is to stick to the Enterprise side of the equation; 2% of Enterprise software companies we’ve been tracking have IPOed — as opposed to under 1% of general software companies and even fewer web companies. Acquisition Happy?Maybe Sarbox has you scared and you just want a big check and a shiny new business card at an acquisitive giant conglomerate. Total funding:If you're up on your self-improvement seminars and realize that the process is more important than the goal (or you just want to raise a bunch of money and have U2 play your launch party) then you can also raise funding. The average amounts of total financing raised by capital-intensive Cleantech, Biotech and Semiconductor companies were 25M, 15M and 14M respectively. TechCrunch CoverageNot into the whole material riches or success thing? Want to be famous but can't hold a tune and have horrible hand-eye coordination? Well, if you want to make TechCrunch, you might want to start one of those web companies. Not shockingly, Web, Mobile and Gaming were the sectors most likely to be covered on TechCrunch with 14, 12 and 11% of CrunchBase companies getting at least one mention. At the bottom of the list was Biotech, with less than half a percent of Biotech startups getting any coverage. The LosersWhich categories should you avoid? Consulting has only had 3% of companies started that end up acquired and less than 0.5% IPOs. And well, for all the current hullabaloo, Education has had 0 IPOs and a 1% acquisition rate. And in last place, Legal companies have also had 0 IPOs and a sub 1% acquisition rate, though the recent filing of LegalZoom should change that dire statistic. * Caveats: All numbers are based on CrunchBase and are backwards looking. Also, there is a fair bit of survivor bias in the results, in that successful companies are more likely to be in the database. Want the full gory details in Table-format? Well here you go:

Photo: Erik Dreyer/Getty Images | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Viacom, DirecTV, And The Future Of TV Blackouts Posted: 21 Jul 2012 03:02 PM PDT  Viacom and DirecTV ended their dispute over carriage fees on Friday, which saw the return of 17 Viacom channels on the cable satellite service. But who won, who lost, and what does the resolution mean for DirecTV, and for the rest of the industry? Given that Viacom reportedly didn’t get what it wanted in the negotiations, it probably will mean even more blackouts as time goes on. Viacom channels weren’t available to DirecTV customers for nine days over the course of the blackout, and in that time key channels like Nickelodeon saw inevitable ratings declines. Ratings at the children’s network fell some 20 percent during that time. Meanwhile, Disney, the channel DirecTV replaced Nickelodeon with, saw its ratings increase a comparable amount. According to Bernstein Research analysts Todd Juenger and Craig Moffett, that implies it was Viacom which came back to the bargaining table and attempted to end the blackout. So what did DirecTV actually win? It’s now reportedly faced with a 20 percent increase for Viacom channels, or an additional $600 million, according to Bloomberg. But, considering that Viacom was reportedly demanding a 30-percent increase, DirecTV seems to have won this round of negotiations. More importantly, Viacom was pushing Epix as part of its bundle of channels, asking an additional $500 million for the channel. It’s not quite the great unbundling that DirecTV CEO Mike White seemed to be talking about in last weekend’s message to subscribers. But by not being pressured into additional fees for a channel that its consumers may not even want, DirecTV’s stand against Viacom seems fairly successful. While blackouts of this type are becoming increasingly common, usually it’s the distributor — the cable or satellite provider — who ends up capitulating and agreeing to the programmer’s terms. In a research note sent to clients, the Bernstein analysts wrote: “The Viacom/DirecTV dispute may be remembered as a critical turning point in programmer/distributor negotiations. For the first time in memory, it was the distributor that won the public relations war.” It’s too early to tell what the overall effect will be on DirecTV’s customer base, and how many subscribers fled to other service providers or just quit altogether. Since the blackout began in July, executives won’t have to talk about third-quarter defections on DirecTV’s second-quarter conference call. That is, unless those defections will have a material impact on the company’s forecast for this quarter. It’s also too early to say whether or not Viacom ratings will bounce back, now that its networks have been reinstated. Summer isn’t a great time for TV anyway, with kids out of school and families going on vacation and generally getting out of the house. But Viacom was already feeling some ratings declines, specifically at Nickelodeon, even before its channels went dark for DirecTV’s 20 million subscribers. But clearly this shows that other programmers who will soon be negotiating with DirecTV — like Viacom sister CBS — should probably expect to be met with similar resolve in the case of a dispute over fees. Juenger and Moffett write: “More significant, perhaps, is the signal that DirecTV has sent to other programmers. By showing their willingness to take a blackout, and arguably winning the battle for the hearts and minds of their customers as a result, DirecTV may extract better terms from other programmers down the road.” All indications are that the DirecTV-Viacom spat was seen as a positive for other cable and satellite providers as well, who might be emboldened to also take the stand against perpetual price increases and further bundling of networks that their subscribers don’t want. The fact that cable companies like Time Warner Cable actually urged subscribers not to switch providers during the most recent blackout just kind of shows how there’s at least some solidarity between distributors. That’s bad news for programmers, who might see growth in their per-subscription fees slow… And it’s especially bad news for consumers, who can probably look forward to more blackouts, regardless of who their service provider is. But for an industry that is beginning to approach an affordability crisis, cable companies are facing an acute need to control costs. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||