Sponsored

The Latest from TechCrunch |  |

- Redpoint Ventures: Making Money the Old Fashioned Way

- Why TV Companies Couldn’t Care Less About Original Online Video

- Zappedy Acquired By Groupon. What’s Zappedy?

- Following Twitter

- Zing! Larry Page Calls Out ‘Competitors’ (aka Facebook) For Lack Of Social Data Portability

- The Underground Promise Of Turntable.fm

- Keen On… Don’t Steal This Book (TCTV)

| Redpoint Ventures: Making Money the Old Fashioned Way Posted: 17 Jul 2011 07:45 AM PDT Last week we broke the news of the impressive-but-not-jawdropping $200 million acquisition of Cloud.com by Citrix and the stellar year of returns that Redpoint Ventures is having. What makes Redpoint’s record so unique is that the firm is having a good year despite the fact that they’re not in one of the big five: Zynga, Facebook, LinkedIn, Twitter, 0r Groupon. Hell, let’s make it a big six and throw in Pandora since the IPO made so much noise. The venture world has never been more polarized between have and have-not firms. There’s talk that Accel is sitting on a fund that will have the highest returns the industry has ever seen, thanks mostly to Facebook. Meanwhile, Greylock must be sitting on one of– if not the– best fund in its history between early stakes in LinkedIn, nicely priced stakes in Facebook and Pandora and a late stage investment in Groupon. Of course no single individual in the venture business may be in a better position to enjoy 2011 than Reid Hoffman: He’s the founder and largest shareholder in LinkedIn, the first money into Zynga, a partner at Greylock, and an angel investor in Facebook. Meanwhile, there are dozens of venture firms on the other side of this divide who are going out of business. Like the kid stuck practicing the violin while he watches his neighbors play football in the yard, these firms can only look on as we endlessly debate whether it’s a bubble or not. It certainly doesn’t feel like 1999 to them. 1999 was a time that anyone with a plausible reason to call themselves a venture capitalist could raise money. These firms– and there are a lot of them– are struggling to raise another dime. My best guess is there are dozens of them, but there could be more. Dying venture firms are like the walking dead. They can have years of staggering around with stakes in still active portfolio companies, hoping they’re still holding a lottery ticket that could put them back in the game. If not, they just slowly wind down. Part of the reason for such an industry disconnect is the polarity of returns. The consumer Web companies that are this cycle’s winners are some of biggest the world has ever seen, thanks to the spread and maturity of the Web, and the fact that most of them have waited so long to seek an exit. But the other big trend has been the feature/app company flip for less than $100 million. It’s been well documented that small and mid-cap companies can no longer go public, and those several-hundred-million-dollar acquisition singles and doubles– like Cloud.com and fellow Redpoint exit Clearwell– have been hard to come by. All of that is what makes Redpoint’s winning 2011 such a hopeful sign that there’s still something in between the two extremes. The firm has found multiple exits affording them returns of 10x or more without stakes in the big Web 2.0 names. They’ve done it through less sexy Internet companies like Home Away, international exits like Qihoo, and some solid doubles and triples in the enterprise business. Redpoint hasn’t counted on lucking into the big score, the firm has made well-reasoned investments at reasonable prices and dug out its own luck. I caught up with Redpoint’s newest partner Satish Dharmaraj on video last week to talk a bit more about the firm’s run. He joined the firm two years ago after a stellar record as an entrepreneur, and Cloud.com was his first deal. We talked about how Redpoint is making money, and we also talked about what it was like for Dharmaraj to be on the other side of the table. |

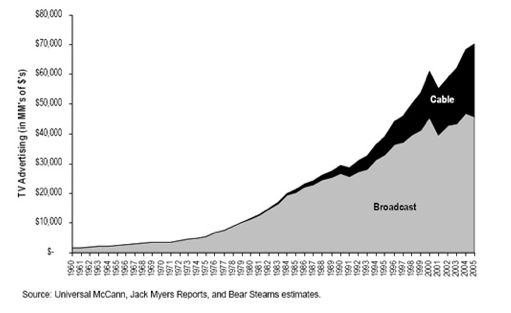

| Why TV Companies Couldn’t Care Less About Original Online Video Posted: 17 Jul 2011 07:00 AM PDT Editor's note: The following guest post was written by Ashkan Karbasfrooshan, founder and CEO of WatchMojo. The rise and proliferation of cable grew the total pie for television, leaving networks with bigger businesses even if their share of the pie shrunk. While the network-to-cable shift was evolutionary, the television-to-web transition is revolutionary. Nonetheless, TV’s Traditional Media Companies (TMCs) are betting that the Web is just another distribution outlet that adds reach and potential revenue to their assets and will grow their business when the dust settles. Whether or not that strategy pays off remains to be seen. After all, the Web made the music business a more efficient one, but the industry shrank in terms of revenues and profits. In any case, while the TMCs have flirted with made-for-web programming (what I call "Premium content"), they have always gravitated back to made-for-television and theatrical content (what I call "Super premium content"). For example, Viacom invested in Vice's VBS.tv back in 2007, but since then they have co-invested in EPIX along with MGM and Lionsgate. Lionsgate itself invested $21.4 million in Break Media for 42% with an option to buy the rest for $58 million. If online video was as amazing as the boosters say, wouldn't Lionsgate had already exercised its option? Break Media has actually executed quite well and carved a nice niche for itself in the men's online video category, but for TMCs, the numbers are immaterial. An Opportunity in Video Content for Startups Who Understand the Fabric of the Web Indeed, the vast majority of premium content has been created by new media startups. The mistake some of these have made has been to build a Traditonal Media Company on top of the Internet, something that is sheer lunacy and a recipe for shattered egos and wasted millions. Ripe Entertainment burned through $40 million and was backed by both VCs (Rho Ventures and Columbia Capital) and TMCs (Hearst Television and Time Warner). Raising $25-50M to build a content business online is a bad strategy, whereby the better you "execute" the worst off you will be. In fact, while this revolutionary shift represents an opportunity for some startups, anyone who is surprised by the TMCs’ reluctance to focus on premium content is either being delusional or disingenuous: there is absolutely zero economic incentive or rationale for TMCs to experiment, let alone invest heavily, in premium content. Admittedly, this is an Innovator's Dilemma at its best, but it's one thing to question TMCs for hesitating to put their offline programming online to chase pennies, it's another to actually wonder why they don't invest in made-for-web programming that has zero existing franchise and traction. Why bother? Way to Encourage Them, Guys Of all of the companies that have received funding or invested in premium content, only a few have had exits:

Meanwhile,

Mind you, slowly but surely, you are seeing some interesting activity:

Hmm … ok, maybe there will be more activity … but don't hold your breath. A few years ago, I contacted Bertelsmann to talk about a partnership to help my company, WatchMojo, expand in Europe. We'd begun translating our English videos into Spanish, French and German and Bertelsmann seemed like a great potential partner. They told me plainly that their focus was how to monetize the thousands of hours of media they had in their archive, and not create new content to monetize online. TV-Envy Killed the Internet Star The common refrain seems to be "television is a $70 billion market, online video is only a $1.5 billion market, when will online video get its fair share"? Um, how about never? Technically, if you include all revenue, television is actually a $250 billion industry in the US. That is a lot of money and the TMCs know that. Online video isn't growing fast enough because:

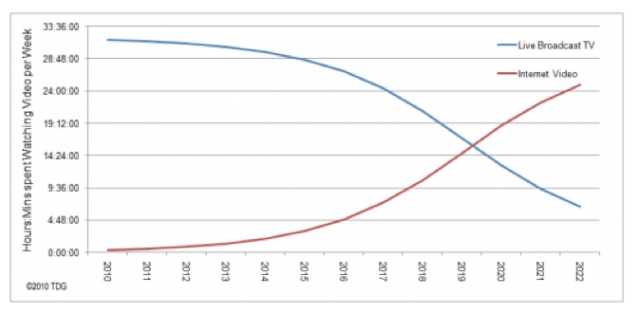

The result is that TMCs lack the economic incentive to invest online since 40% of online advertising's rapidly growing pie goes to search, and only $1.5 billion will be spent on online video advertising in the U.S. Balance sheet vs. Income statement Lost in the "will Hulu sell?" talk is "why would the owners want to sell?" Hulu raised $100 million at a $1 billion valuation. Even if Hulu's value has risen since that deal, the increased value on the TMCs' balance sheets means little. However, if Hulu (in the hands of someone else, be it as an independent post-IPO company, or in the hands of MSFT/YHOO/GOOG) pays the TMCs hundreds of millions of dollars per year in licensing fees, then that kind of annuity on their income statement will be far more valuable. This is why suddenly Netflix has become not just a frenemy but a dear pal to the TMCs, because Netflix can sign big checks each year to the TMCs (lending further credence to the fact that content and distribution are equally important and one without the other is worthless). To conclude: Yes, there is an opportunity for new media startups to create lean, efficient, content creating machines online, especially with web video set to overtake live broadcast TV by 2020 in terms of time spent watching. But, thinking that TMCs should follow suit is lunacy. They are better off thinking up ways to monetize their traditional assets, even if that means repackaging some/all of it for snack-size consumption among online audiences. Over time, the distribution platforms will converge, but control of the content will become a bigger issue than ever. The solution to their problem isn’t "more content.” |

| Zappedy Acquired By Groupon. What’s Zappedy? Posted: 17 Jul 2011 12:22 AM PDT An anonymous tipster tells us Zappedy, a company that offered various technology products for local businesses, has been acquired by Groupon, information that turns out to be correct according to a message posted on the former’s website (which, sadly, hasn’t been archived by the Wayback Machine). There’s isn’t much information about Zappedy on the Web altogether, but here’s what I’ve been scraping together thanks to my phenomenal Web searching skills: Zappedy was founded in early 2010 and was backed by Innovation Endeavors, the investment firm founded by former Google CEO Eric Schmidt. According to its AngelList profile, Zappedy was funded by IE’s Dror Berman and Corey Ford, specifically. Bling Nation co-CEO and founding partner of investment firm MECK Wences(lao) Casares also turns up. And according to their LinkedIn profiles, Innovation Endeavors’ (and TokBox founder) Ron Hose and Project Slice co-founder Harpinder Singh Madan were also advising Zappedy. This is how the startup is described on the Innovation Endeavors website:

Notably, it looks like Zappedy participated in Startup Chile, a program of the Chilean Government to attract early stage entrepreneurs and sway them into starting their businesses in Chile. You can find a short interview with Zappedy co-founder Na’ama Moran here (also embedded below). From what I can gather, Zappedy basically enabled small local businesses to easily create a website and advertise online through social media and daily deal websites simply by sending emails. Groupon likely acquired the company for its team but possibly also for the technology (to be able to offer more tools for merchants who don’t have a strong online presence yet). Zappedy was co-founded by not only Moran but also Francisco Larrain, Daniel Pérez Rada and Ricardo Zilleruelo-Ramos (at least according to their respective LinkedIn profiles). Another interesting name that turns up when perusing LinkedIn is Brad Griffith, a former business developer at LOLapps and, before that, a senior financial analyst at Google. I’ve contacted Groupon, Zappedy and Innovation Endeavors, but since it’s weekend and not exactly the perfect time to reach people, I don’t expect to get more information rapidly. For a list of acquisitions by Groupon, check their CrunchBase profile (left sidebar).  |

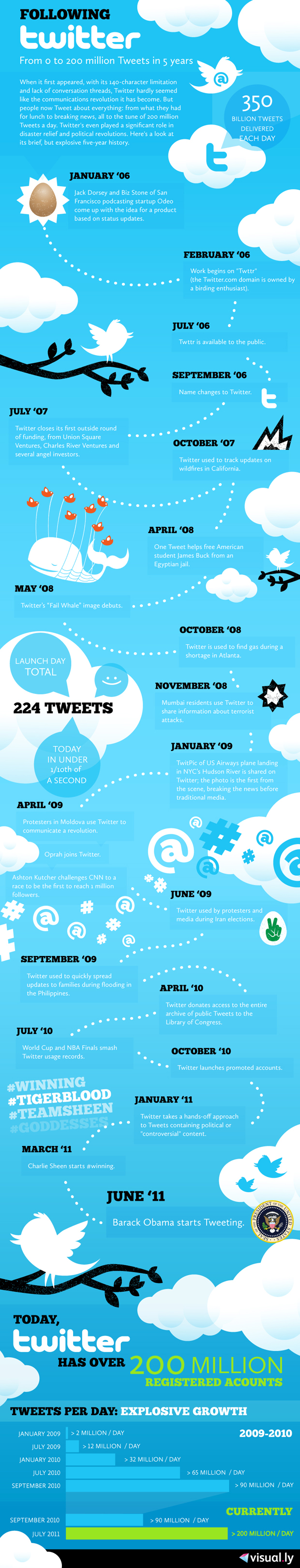

| Posted: 16 Jul 2011 01:02 PM PDT In honor of Twitter's fifth anniversary the folks at Visually have made the following graphic plotting out key milestones on it’s path to 200 million tweets a day. Following Twitter, get it?

|

| Zing! Larry Page Calls Out ‘Competitors’ (aka Facebook) For Lack Of Social Data Portability Posted: 16 Jul 2011 12:15 PM PDT At the end of yesterday’s Google earnings call, CEO Larry Page made a very interesting comment about data portability, Google+, and competitors (aka Facebook). In the call, an analyst asked Page what the most compelling reasons are to switch from existing social platforms to Google+ or if the company sees a future where people can be a part of multiple social networks and platforms (paraphrased, at the 57 minute mark in the call). Page responded with this statement on Google+ and switch costs: We are really excited about about Google+ improving the overall social experience and making it more like how you would share in real life. That’s different than what’s out there now. We are getting rave reviews for that. People really like being able to share with more discreet groups in an easy more intuitive way. There’s a lot of magic built into the product that causes that…Google as a company believes in users owning their own data and being able to easily move it out of Google. Some of our competitors don’t believe in that. We think users will eventually move to services that are in their best interests and that work really well for them. Clearly, Page is referring to Facebook in his statement above, which has notoriously been uber-protective (bordering on restrictive) around exporting data from its network into clients like Gmail. And for some time now, data portability has been a heated battle between Google and Facebook. Facebook recently blocked a number of contact-exporting tools that aimed to take data out of the social network to import into other services (i.e. Google+). And how could we forget the infamous Facebook-Google back and forth over sharing contacts. Last year, Google began blocking Facebook API access to download Google contacts. Facebook hacked its way around that, and Google subsequently issued a statement that they were "disappointed". Facebook Platform engineer Mike Vernal then responded in the comments of one of our blog posts about the slap fight, defending Facebook’s policy and calling it “consistent”. Shortly afterwards, a new chrome extension that allowed you to scrape your Facebook contact information into Gmail was blocked Google. The key part of all this is reciprocity—Google feels that since they are providing the ability to export Gmail contact data to Facebook, Facebook should allow Gmail users to do the same. And they don’t. With Google+, the search giant is offering a data liberation product called Google Takeout, which gives you the option to download all of your profile data, stream data, photos from Picassa, Buzz data, Circles and Contacts. You can download it and do what you want with your data. Facebook also allows you to download a zip file of your photos, friend lists, messages, and wall posts, but it is not in a format third party sites can use, which is why Page made the passive aggressive remark. There’s no doubt that he was referring to Facebook when talking about competitors not having the same open data portability position. There’s no doubt that Google+ is growing fast in terms of usage, and its hard for Facebook to ignore this. In fact, Facebook CEO and founder Mark Zuckerberg made his own Google+ dig at a recent press event. Fast growth and engagement aside, data portability between Google and Facebook will continue to be an issue until both companies settle this and call a truce. The question is whether the battle has gone too far for a reasonable peace treaty to be made. Photo credit/Flickr/dominiekt |

| The Underground Promise Of Turntable.fm Posted: 16 Jul 2011 12:00 PM PDT Editors Note: Guest contributor Semil Shah is an entrepreneur interested in digital media, consumer Internet, and social networks. He is based in Palo Alto and you can follow him on Twitter @semilshah. One of the most prolific vinyl collections belongs to a DJ who only surfaces every now and then. And when he does, legions of fans wait on baited breath, desperate to taste the latest brew from Josh Davis, otherwise known as DJ Shadow. DJs like Shadow usually begin creating underground. Their music is the result of months of sampling and cutting to form entirely new sounds. These new tunes form in darkness, outside the purview of record labels, radio stations, and the majority of listeners. It’s a bit romanticized, but there’s also much truth to the underground creative process and secretive DJ battles that occur in real life, where other DJs rate their peers. For those who have witnessed a live battle, it’s a unique environment where an unknown DJ can conceivably, on any given night, spin records better than pros like DJ Shadow. Yes, this is another post about Turntable.fm. TechCrunch’s Erick Schonfeld was the first to write about the service back in May. Since then, it’s taken off like a hot summer single. Nearly everyone believes Turntable could become a big deal, though it faces dangerous landmines (see below) and may struggle to stay in the limelight now that Spotify has launched in the U.S. There’s a great story about the company’s pivot and creation of the service. Investors have circled around Manhattan, and the company’s Series B should be announced soon. Every tech blog and Quora have covered its rise numerous times, it’s technology stack, how it could make money, how to create playlists, a live DJ event in NYC, and even mainstream pubs like The New York Times weighed in. I won’t regurgitate or summarize any of the coverage thus far, but many of these pieces miss the key points about why this site has so much promise. I’d like to shine some light on these. First, the Turntable.fm platform could help level the playing field for aspiring DJs and musicians to build their reputation, their audience, and perhaps even get discovered. In the real world, DJs create tracks and battle underground, earning their reputation by performing in various venues, trading mix tapes, referencing (or dissing) their peers, and incorporating new tricks into their cuts. What has been happening underground for years may now slowly be coming online, where someone could moonlight as a DJ and, perhaps even be discovered by a club or promoter. Second, even folks who love Turntable remain skeptical about its prospects in a music world that contains Pandora, iTunes, Rdio, and now Spotify, which will feature some integration with Facebook. I believe there will be room for all of these services and that they each satisfy different needs. In other words, Turntable won’t “kill” Pandora nor be “killed” by Spotify, which may not “kill” Rdio. Pandora is about letting machines learn your music tastes and help you discover new tunes. Recently, it announced its own social layer. iTunes wasn’t able to break into social with Ping, though a young startup Rexly is trying to crack the code. Spotify, which launched this week and may integrate with Facebook, could offer more choices than iTunes for less money and theoretically could recreate the “social rooms” ambiance of Turntable. All of these services carry a large song inventory, largely composed of mainstream music, both current and extensive back catalogs. Not everyone’s tastes are mainstream and/or homogenous, however. For some, buying music on iTunes is simply boring, chock full of pop hits and TV soundtracks. A service like Turntable allows users to organize themselves by type of music, geography, work groups, and so forth, and helps unlock niche areas of music that make up an interesting long tail in discovery. Third, there’s widespread fear of record labels and licensing fees. The labels could conspire to kill this service, and their track record isn’t pretty. Or, Turntable could die under the weight of onerous licensing fees. On the other hand, the record companies are so beaten up that they may have actually reached a point where may want a service like Turntable to succeed, so that it cannot burn bridges to future distribution channels, especially now given the promise around Spotify. While I wouldn’t underestimate the battle scars inflicted on the likes of Napster or Grooveshark, it seems the tide continues to move in favor of the consumer, and that the timing for Turntable could actually be impeccable. Finally, the most exciting future possibility for Turntable is mobile and crowd interaction. Right now, there isn’t a mobile application, and given the user load issues the site is experiencing, it may be a while before they build this. For now and the foreseeable future, Turntable’s music will be heard through laptops and desktops, where a small few could create new content, and some others could help spread it through voting, and help it reach the remaining mass of listeners. Imagine being at a club during a DJ battle where audience members could register their votes via mobile apps or SMS, in addition to their applause? Or, maybe you’ll want a certain crew of DJs to play at your birthday party in San Francisco, but they’re located in Berlin—a service like Turntable could help bridge that gap, and offer your guests a chance to chime in on the music selection. All of these possibilities surround audio files, but is there room for video, too? I recognize it’s early days for the Turntable.fm team. I don’t mean to suggest that overcoming any of these hurdles will be easy. In fact, it will be extremely interesting to see who joins as an investor in the Series B round, because an endeavor like this will require both entrepreneurs and investors taking the fight to the record industry, or creating incentives for them to play along nicely. In some ways, it reminds me of Quora with its up-votes, entering “rooms” instead of following “threads,” and could also follow the 1-9-90 rule of content generation—where 1% create new music on the site, 9% help spread it by voting and sharing, and the rest of us consume it. Among most music fans I run into who have tried Turntable, there’s this initial, almost indescribable fascination with the service and shared desire to see it to succeed despite any challenges. They have cultivated a great deal of good will. There are other real threats to the service. Will DJs and even casual listeners experience fatigue of waiting too long to DJ or hanging out in empty rooms? Will the technology stack hold up to the incredible demand for the service, especially when a celebrity DJ wants to spin for his or her fans? Or will the site succumb to trolls, invasive brand accounts, or SPAM? Is the site really about discovering music, or just chatting about music, or both? Or is this entire package seen as a possible antidote to Spotify’s upcoming Facebook plans, where Turntable could be gobbled up as a strategic acquisition, especially for artists and record labels who may be uneasy abowithut Facebook’s growing footprint in media? Turntable.fm has the makings of a huge hit, already attracting world renown DJs like Questlove and Diplo. Perhaps even DJ Shadow will give the site a whirl before he releases his new album later this fall. For someone like Shadow, selling out shows worldwide isn’t a problem. Reaching new fans is, however. And, there may just be that part of him which misses the old days of DJ battles, something his status now rarely affords him. A site like Turntable.fm could give him and a variety of other established or hopeful artists an entirely new platform to test new beats, find others to collaborate with, test geographic demand for new music, interact with fans, sell albums and merchandise, play special shows online, and so much more. The possibilities are endless. That is the promise of Turntable.fm—and here’s to hoping it all gets realized one day. Image credit: David Torcivia |

| Keen On… Don’t Steal This Book (TCTV) Posted: 16 Jul 2011 10:00 AM PDT “Steal this book,” wrote Abbie Hoffman in 1970. So, today, why should we pay for our books – especially in a digital age where intellectual theft is both ubiquitous and pretty much risk free? According to Gary Shteyngart, the best-selling author of novels like “Super Sad True Love Story” and “Absurdistan,” paying for his books means that he doesn’t have to work at a gas station or a car dealership. When we pay for one of his books, Shteyngart explained when we spoke earlier this week, it “allows me to produce more work.” Buying a book, he insists, represents an investment in creativity. And creativity – real creativity – may be at a premium today – at least according to Shteyngart. As he argues, the Internet may be killing our eccentricity and transforming all of us into 140-character conformists. Thus, in today’s networked age, he says, there is an acute need for writers who can grab our attention and drag us away from broadcasting our boring selves on Facebook and Twitter. This is the second in a two-part interview with Shteyngart. Yesterday, he explained why, in the not-too-distant future, everyone will know everything about everybody. Don’t steal this book How to get to William Gibson land Have words lost their power? |

| You are subscribed to email updates from TechCrunch To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment